Introduction

Executive condominiums (EC) are a popular type of housing in Singapore. It was introduced in the 1990s, as an intermediate housing category to bridge the gap between public housing flats and private residential properties – helping Singapore households attain their aspirations of owning and living in a private home.

Many of these households belong to the “sandwiched class”, who are unable to apply for build-to-order (BTO) flat from the HDB as they have exceeded the monthly household income ceiling, but yet find private condos out of reach due to the higher prices. At the time of writing, the monthly income ceiling for BTO flats for couples/families is $14,000, while the income ceiling for new ECs is $16,000.

This public-private housing hybrid, built and sold by private developers, offers standard private condominium facilities but at much lower prices compared with private condos. Buyers of new EC units have to meet eligibility criteria similar to buying HDB flats, and there are certain conditions such as the 5-year minimum occupation period, and some resale and rental restrictions, which are lifted 10 years after obtaining the temporary occupation permit – when the EC project becomes fully privatised. Eligible buyers may be able to receive a housing subsidy of up to $30,000 under the CPF Housing Grant Scheme, when they purchase an EC unit from developers.

Through the years, EC projects have been popular with eligible buyers who are mainly first-timer home buyers or HDB upgraders owing to the more affordable pricing compared with private condos. However, in the past years, PropNex notes that prices of new ECs have risen steadily, and there are some concerns as to whether this housing type can still adequately meet the needs, and budget of middle-class Singaporean households.

Summary of Key Findings

About 4 in 10 respondents agree that executive condominiums (EC) are still relevant in meeting the aspirations of the middle- and upper-middle income home buyers in owning a private home.

More than half of respondents find that the prices of new EC units – with the median price having crossed $1,400 psf – are unaffordable.

The most popular suggestion amongst respondents to improve EC affordability was to bump up the supply of ECs by increasing the number of such government land sales (GLS) sites for tender.

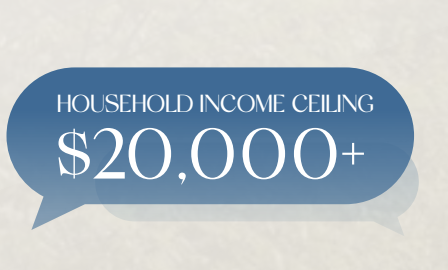

Meanwhile, nearly half of the respondents felt that raising the monthly household income ceiling for the purchase of new ECs will help to improve affordability of such homes; about six in 10 of these respondents said the income ceiling should be revised to $20,000 or higher – from the current $16,000.

Survey Overview & Respondents’ Profile

PropNex conducted a survey to assess the current sentiment of HDB owners and residents on the executive condominium market, whether the EC model is still relevant to the middle class and whether it is meeting its intended objectives.

The survey, which was conducted between mid-March to end April 2024 via various social media/online channels, at a consumer seminar, and through PropNex’s network of real estate agents drew nearly 1,250 valid responses. The respondent pool was limited to HDB flat owners who are presently residing in their flat.

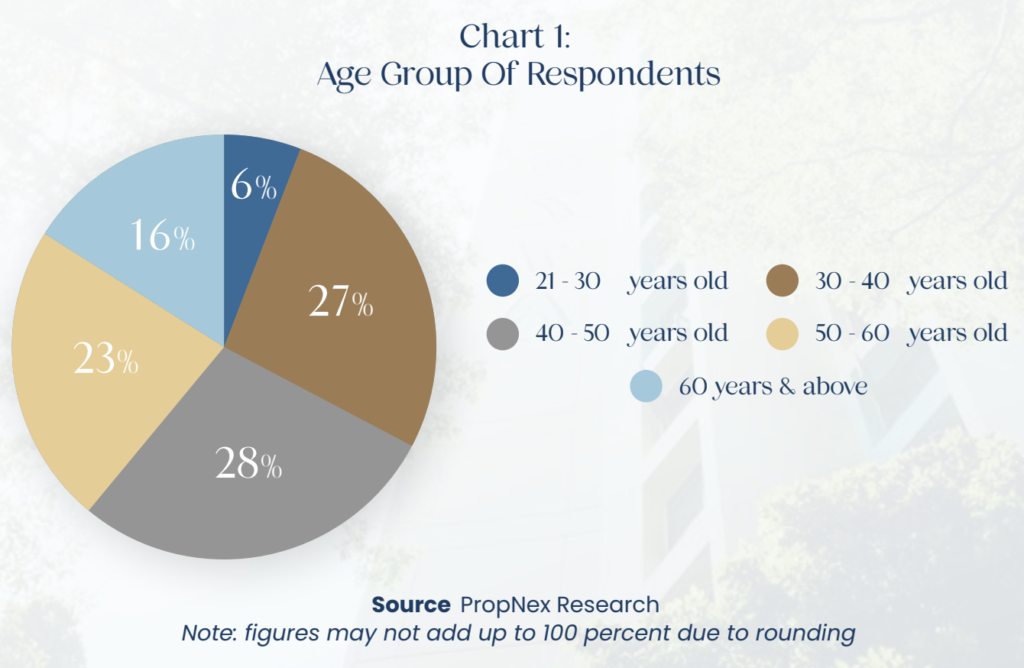

About 28 per cent of the respondents are aged between 41 and 50 years old, forming the largest proportion of those polled. This was followed by those aged between 31 and 40 years old, who accounted for 27 per cent of the respondents. Meanwhile, respondents aged between 51 and 60 years old, above 60 years, and those 30 years old and below made up 23 per cent, 16 per cent and 6 per cent of the people surveyed, respectively (see chart 1). By nationality and residential status, about 95 per cent of respondents are Singapore citizens, while 5 per cent are Singapore Permanent Residents.

More than a third of the respondents (39 per cent) have identified themselves as holding PMET jobs (Professional, Managerial, Executive, Technical), while about one-third of them (33 per cent) said they are self-employed. The remaining 28 per cent of respondents include retirees, freelancers, and those holding jobs in the services sector, amongst others.

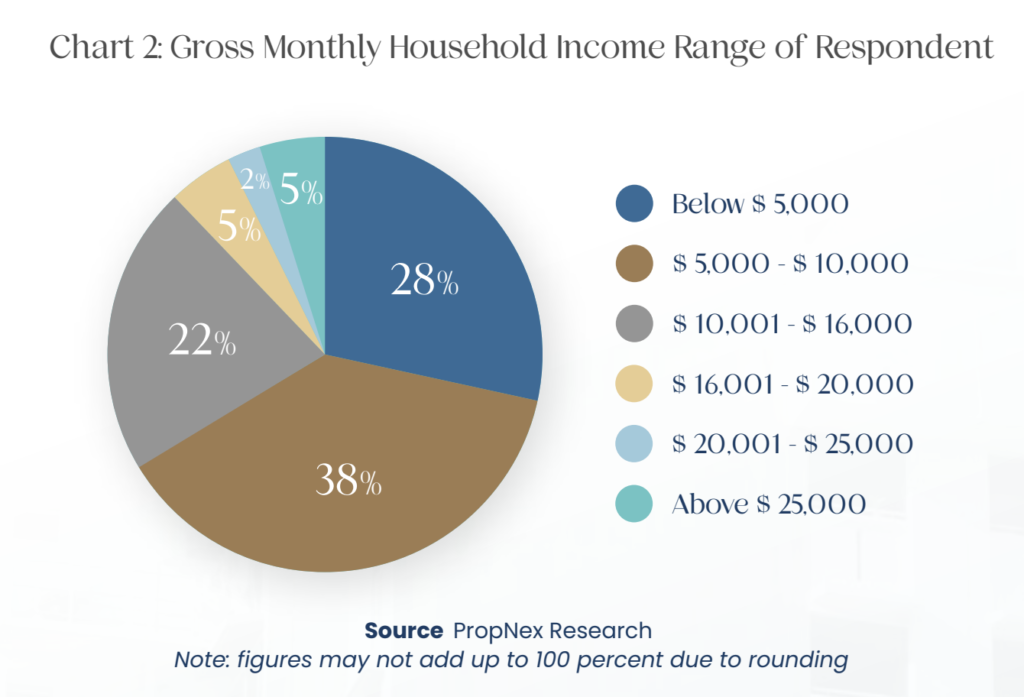

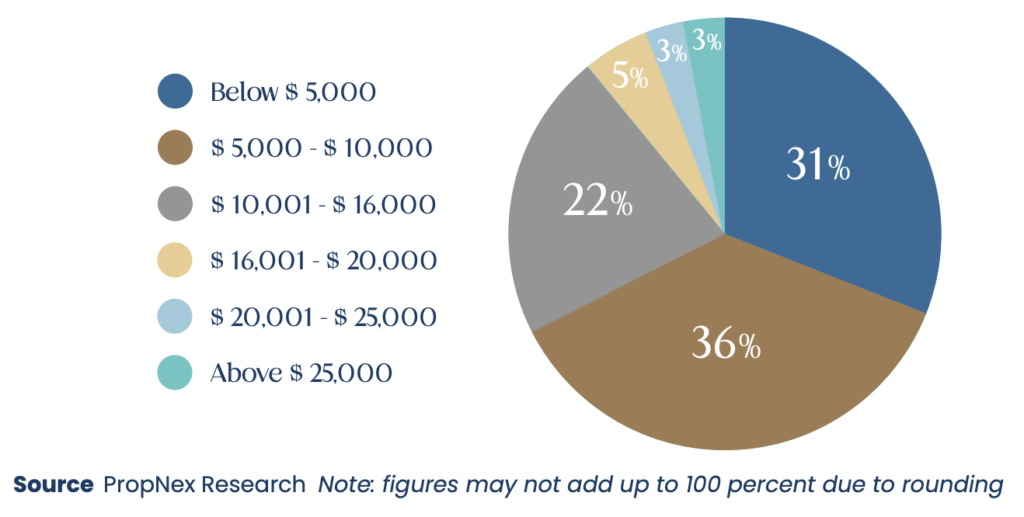

In terms of income, about 38 per cent of the respondents have a monthly household income of between $5,000 and $10,000, forming the largest proportion of those polled. This is followed by those with household income of below $5,000, who accounted for 28 per cent of the respondents. Meanwhile, respondents with household income of between $10,001 and $16,000 made about 22 per cent of the respondent pool. Respondents with an income of above $16,000 accounted for about 12 per cent of the people surveyed (see Chart 2).

PART ONE

Relevance of ECs

Private home prices have risen consecutively for seven years since 2017, with stronger price growths observed in the past three years: 10.6 per cent increase in 2021, followed by the 8.6 per cent and 6.8 per cent growth in 2022 and 2023, respectively. Amid the upward climb in private home prices, the EC housing type has become even more important for many households in the “sandwiched class” as a means to enter the private housing segment.

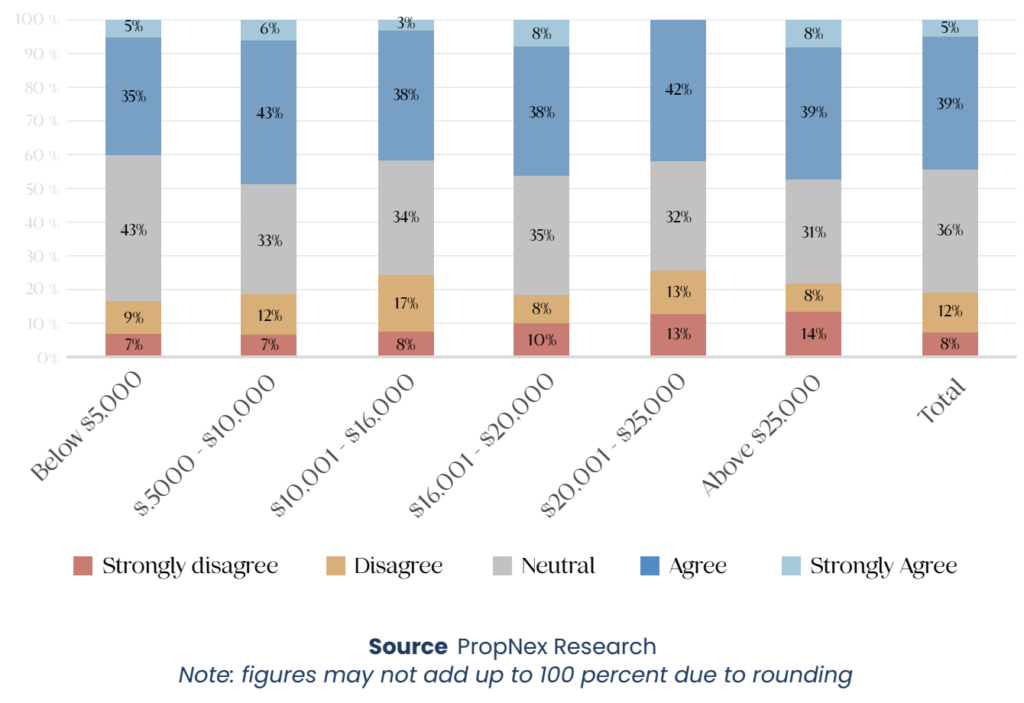

Survey findings showed that about four in 10 (39 per cent) the respondents polled agreed that ECs are still relevant in its role of catering to the housing aspirations of middle- and upper- middle income families in owning a private home. Meanwhile, about 5 per cent of the respondents strongly agreed that ECs are still relevant. By contrast, some 20 per cent of those surveyed either disagree or strongly disagree that ECs are relevant in meeting their housing aspirations (see Chart 3, Total column).

Analysing the findings further, it was observed that a sizable portion of respondents across all household income bands agree or strongly agree that ECs remain relevant, with the biggest proportion (49 per cent) seen in among those earning between $5,000 and $10,000 a month, and the smallest proportion among respondents with a household income of below $5,000 per month.

It is perhaps not unexpected that a good number of respondents feel that ECs are adequate in meeting their private housing aspirations. Despite the gradual climb in the prices of ECs of late, this housing type remains one of more accessible and affordable private residential properties in Singapore for mass market home buyers.

Chart 3:

Do you agree that ECs are still relevant in its role of catering to

private housing aspirations of middle and upper-middle income families?

By respondents’ household income

PART TWO

Affordability of ECs

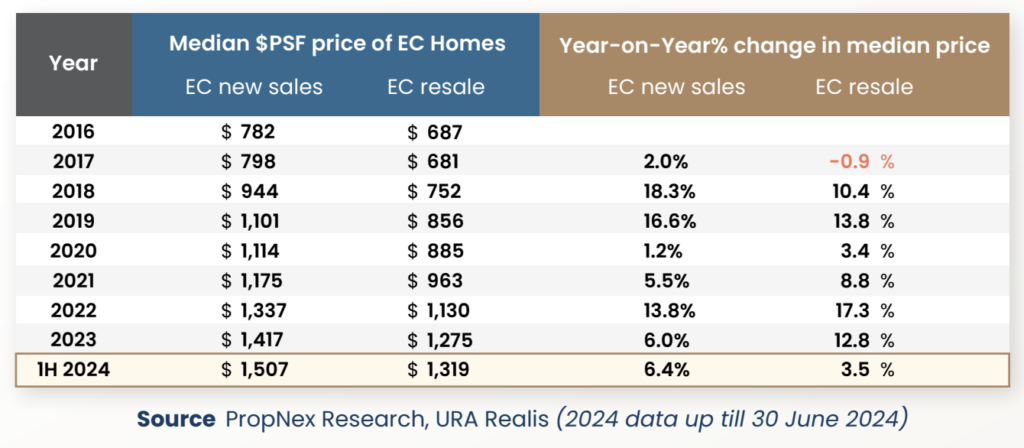

The survey also sought respondents’ views on the affordability of ECs. Based on URA Realis caveat data, the median unit prices of new ECs and resale ECs have seen relatively strong growth on a year-on-year basis. In the first half of 2024, the median unit price of new ECs has crossed $1,500 psf, while that of resale ECs touched $1,300 psf (see Table 1).

Table 1: Median unit price ($PSF) of ECs (new sales and resales)

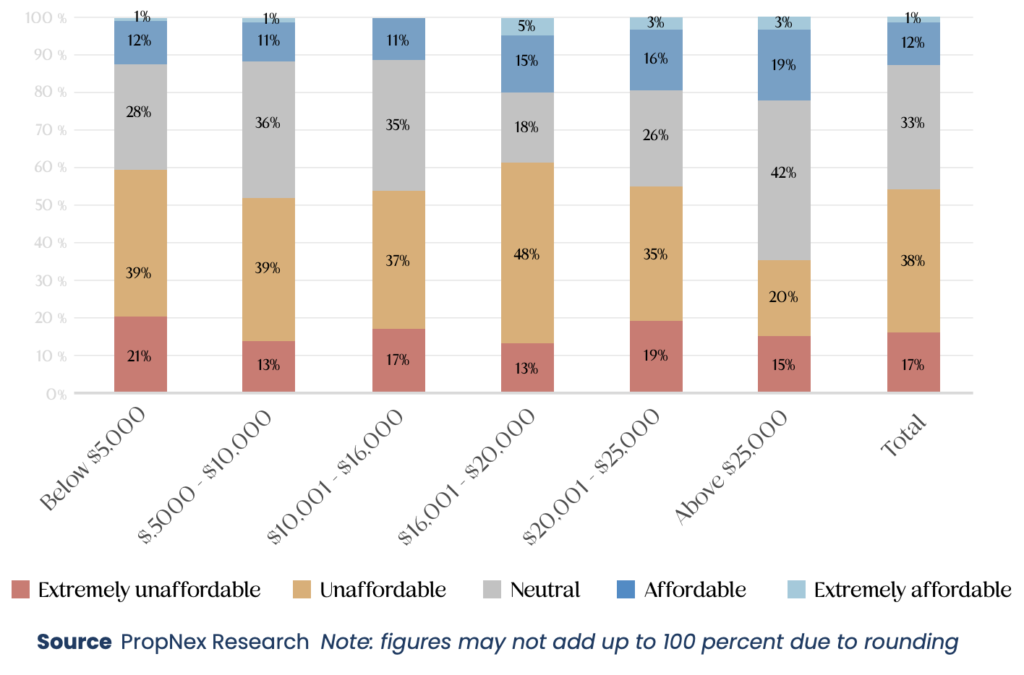

Respondents were polled on their views about the current prices of new EC project launches. More than half of respondents (55 per cent) indicated that the current prices are unaffordable or extremely unaffordable; about 13 per cent of those polled felt that EC prices are affordable or extremely affordable (see Chart 4, Total column). Among the 55 per cent of respondents who indicated that EC launches are unaffordable or extremely unaffordable, over a third (36 percent) of them draw a monthly household income of $5,000 to $10,000, while 31 per cent of them earn below $5,000 a month (see Chart 5).

Focusing on income bands which fall under the eligible income ceiling of $16,000 for new EC purchase, 60 per cent of respondents who earn below $5,000 a month said EC launches are either unaffordable or extremely unaffordable. Among respondents with a monthly household income of $5,000 to $10,000, 52 per cent felt EC launches are unaffordable or extremely unaffordable, while 54 per cent of those who earn $10,001 to $16,000 a month thought the same (see Chart 4). This then raises the question of whether the existing income ceiling is adequate, which will be showcased in the later part of the report.

Chart 4: What are your views on current prices of new EC launches

which crossed the $1,400 psf mark?

By respondents’ household income

Chart 5: What are your views on current prices of new EC launches

which crossed the $1,400 psf mark?

By respondents’ household income (Extremely Unaffordable / Unaffordable)

PART THREE

Suggestions to improve EC affordability

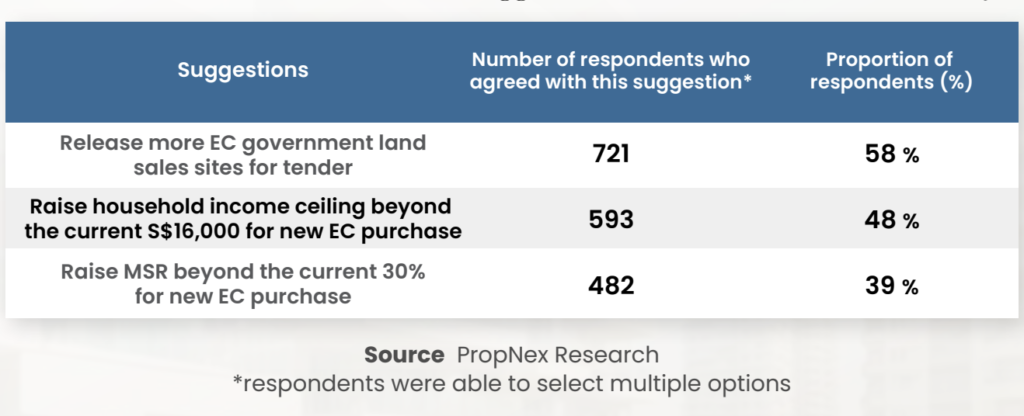

The respondents were polled on various suggestions to improving the affordability of ECs. More than half of respondents (58 per cent) agreed that the government should release more EC sites for tender. Meanwhile, just under half (48 per cent) of respondents felt that the government should raise the household income ceiling beyond the current $16,000 for new EC purchase. More than a third of respondents (39 per cent) concurred that the government should relax the MSR (Mortgage Servicing Ratio) which is currently pegged at 30% of the monthly household income. (See Table 2).

Table 2:

Number of responses on various suggestions to improve EC affordability

Some other potential solutions that were suggested by respondents include setting a price cap on new EC units launched for sale, setting a cap on the land bid prices for EC sites sold via the government land sales (GLS) programme, further tightening the eligibility criteria for buyers, and increasing government subsidies or grants to eligible buyers of new ECs.

Suggestions to improve EC affordability:

1. Adjusting the Mortgage Servicing Ratio (MSR) for EC purchase

Of note, more than half of respondents felt that the government should increase the supply of EC sites. In the last few years, the government has released only two EC sites on the Confirmed List for public tender each year, leading to stiffer competition for such sites among developers and thereby contributing to higher land bids. Typically, developers are attracted to EC plots given the strong demand for such homes among buyers, and the generally healthy take-up rates at launch.

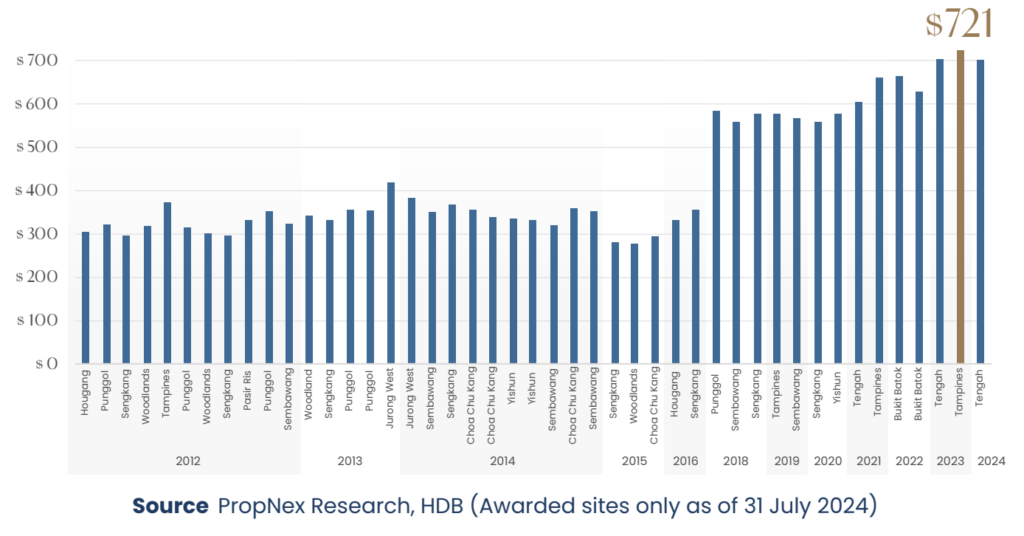

Chart 6: EC GLS Tender Prices from 2012 to 2024 ($psf ppr)

Land rate ($psf ppr)

Table 3: EC GLS Average Tender Prices ($psf ppr) and number of GLS sites from 2012 to 2023

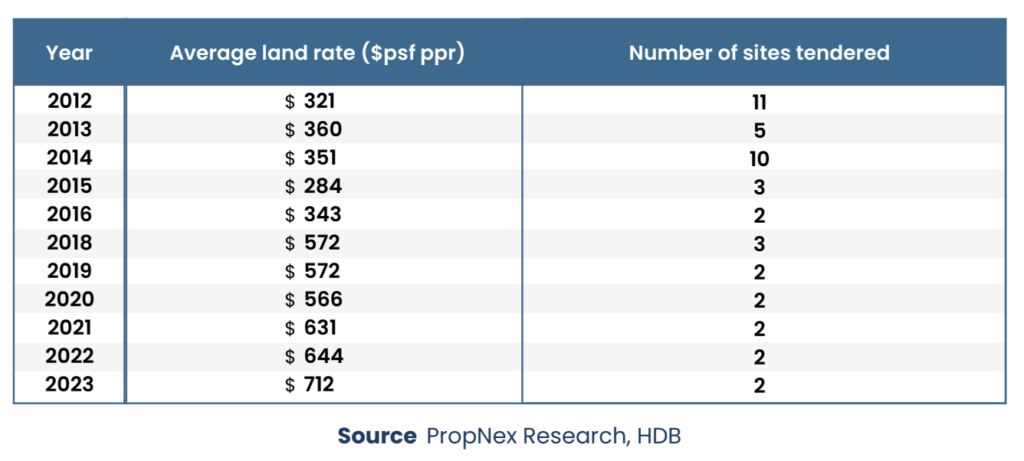

Between 2012 and 2018, multiple EC sites were sold each year – averaging about six sites per year – compared with two sites per year from 2019 to 2023 (see Chart 6 and Table 3). The GLS EC land rate breached the $500-psf per plot ratio (psf ppr) mark in 2018 when the Sumang Walk EC site was awarded for $583 psf ppr. Since then, the record land rate has been rewritten several times, with the plot in Tampines Street 62 (Parcel B) currently holding the record EC land rate at $721 psf ppr.

2. Adjusting the Mortgage Servicing Ratio (MSR) for EC purchase

The Mortgage Servicing Ratio (MSR) refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans. The MSR is capped at 30% of a borrower’s gross monthly income and only applies to home loans for the purchase of an HDB flat or an EC (where the minimum occupation period of the EC has not expired). It is a measure aimed at ensuring that buyers are prudent in their property purchase, and do not overstretch themselves. The MSR was first set at 40% during its inception, and it was eventually brought down to 30% in 2013 for housing loans granted to HDB flat and new EC buyers.

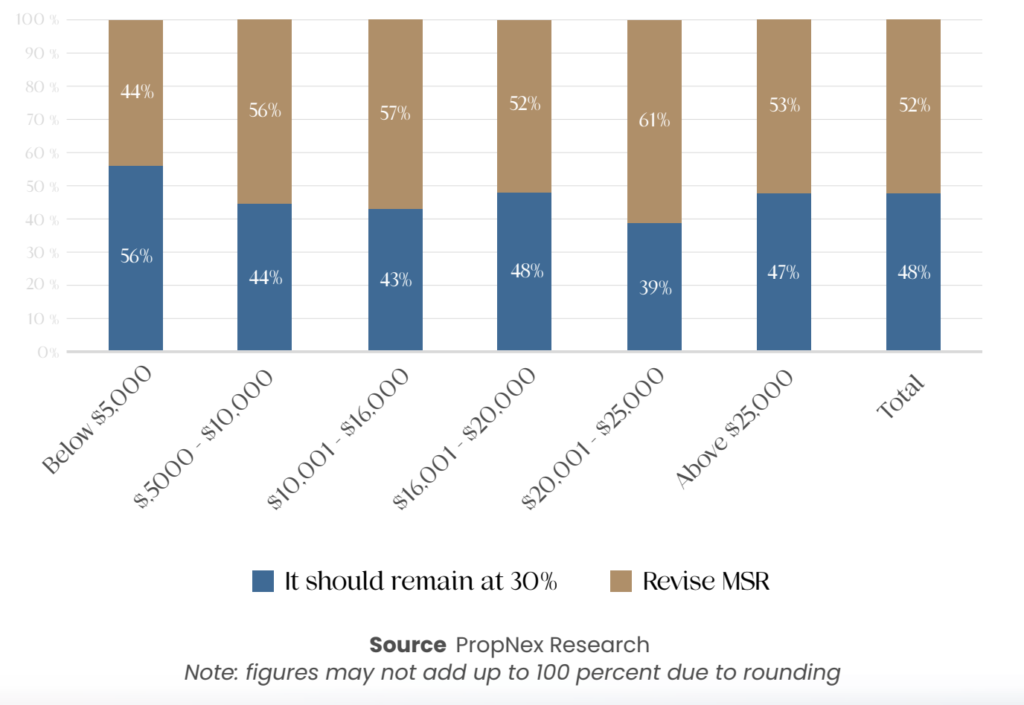

Survey findings showed that 52 per cent of the respondents felt that the MSR should be revised (see Chart 7, Total column) for EC purchase. It is not unexpected that more than half of the respondents are in favour or revising the MSR, given the disparity between prices of ECs and HDB flats. As ECs cost more than HDB flats, the MSR for EC purchase should arguably be higher.

Chart 7: Should the MSR for EC purchase be revised?

By respondents’ gross household incomes

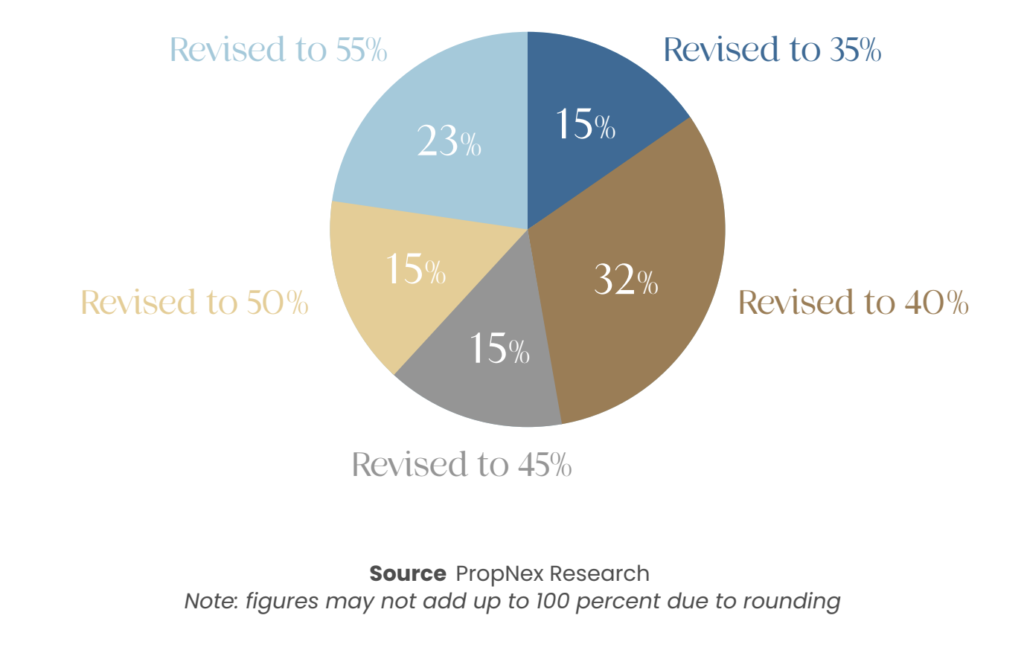

Respondents who sought a revision in the MSR for EC purchase were then asked to indicate the ratio at which it should be adjusted to. Interestingly, more than half of these respondents said that it should be increased to 45% or higher, with a significant portion (23 per cent) indicating that MSR should be raised to 55% (see Chart 8) – which would have put the MSR on par with the total debt servicing ratio (TSDR) framework. The TDSR applies to private residential properties and limits the monthly debt repayments to 55% of the borrower’s gross monthly income.

Chart 8: If it is to be revised,

which is the appropriate MSR level for EC purchase?

Meanwhile, a substantial portion of the respondents (32 per cent) indicated that the MSR for ECs should be raised to 40%, while 15% of the respondents opted for the MSR to be adjusted to 35%.

Overall, about 48% of the respondents (see Chart 7, Total column), felt that the MSR for EC purchase should not be revised – perhaps cognizant of the potential that this could encourage EC developers to raise prices.

3. Raising the income ceiling for EC purchase

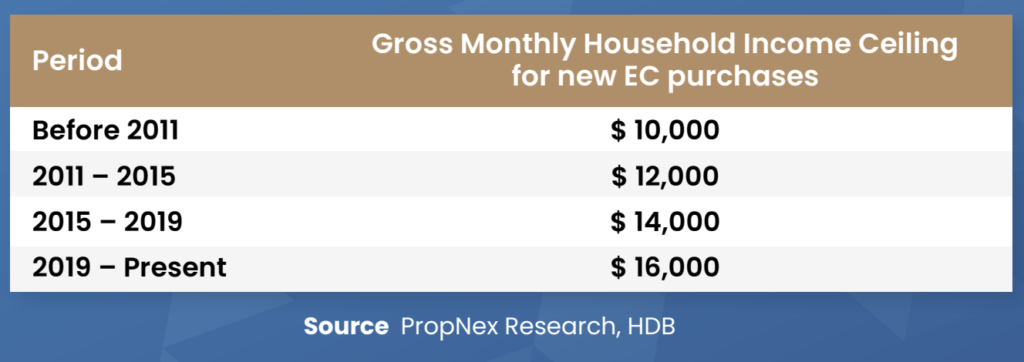

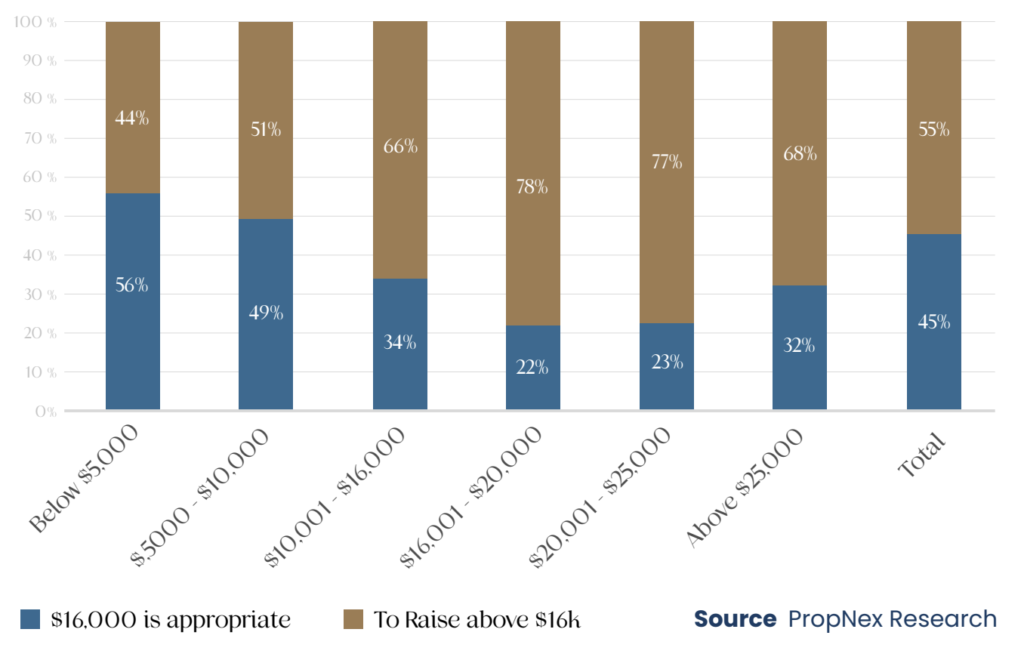

Currently, the prevailing monthly household income ceiling for buyers of new ECs is set at $16,000, having been adjusted up from $14,000 in 2019 (see Table 4). Survey findings indicated that about 55 per cent of all respondents agreed that the income ceiling should be adjusted (see Chart 9, Total column), with those in the higher income brackets feeling most strongly about this – unsurprising, given that a raise in the income ceiling could make them eligible to purchase new ECs.

Table 4: History of Executive Condominium Income Ceiling revisions

About 78 per cent of those earning $16,001 to $20,000 a month concurred with revising the income ceiling – making it the largest proportion among the various income brackets seeking for change. This is followed by respondents with a monthly household income of between $20,001 to $25,000, with 77 per cent of them in favour of revising the income ceiling (see Chart 9). These findings suggest that there is a strong desire among many HDB flat owners in the higher income groups to upgrade to a new EC.

Chart 9: Should the income ceiling be revised?

By respondents’ household income

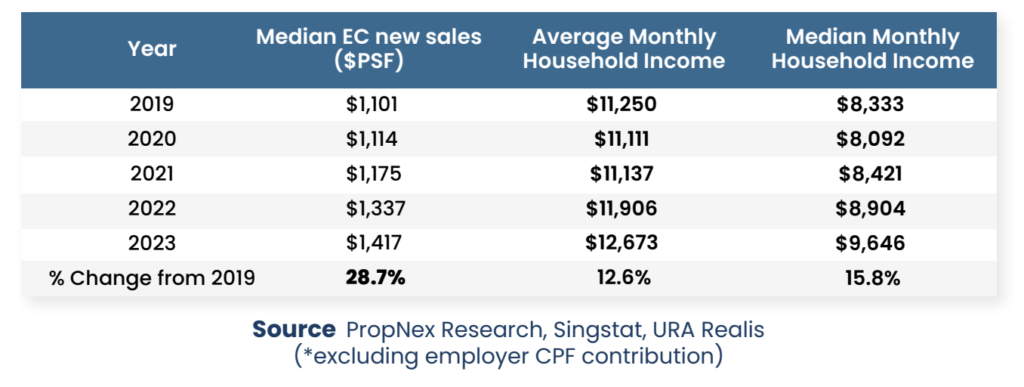

Based on data from the Department of Statistics, the median household income amongst resident employed households have grown to $9,646 in 2023, up by about 16% from $8,333 in 2019. For simple comparison, median prices of new EC homes rose by nearly 29% from 2019 to 2023, outpacing the growth in median monthly household income (see Table 5).

Table 5:

Median EC new launch prices ($PSF) vs Average & Median Household Income*

amongst resident employed households by year (2019 – 2023)

Chart 10:

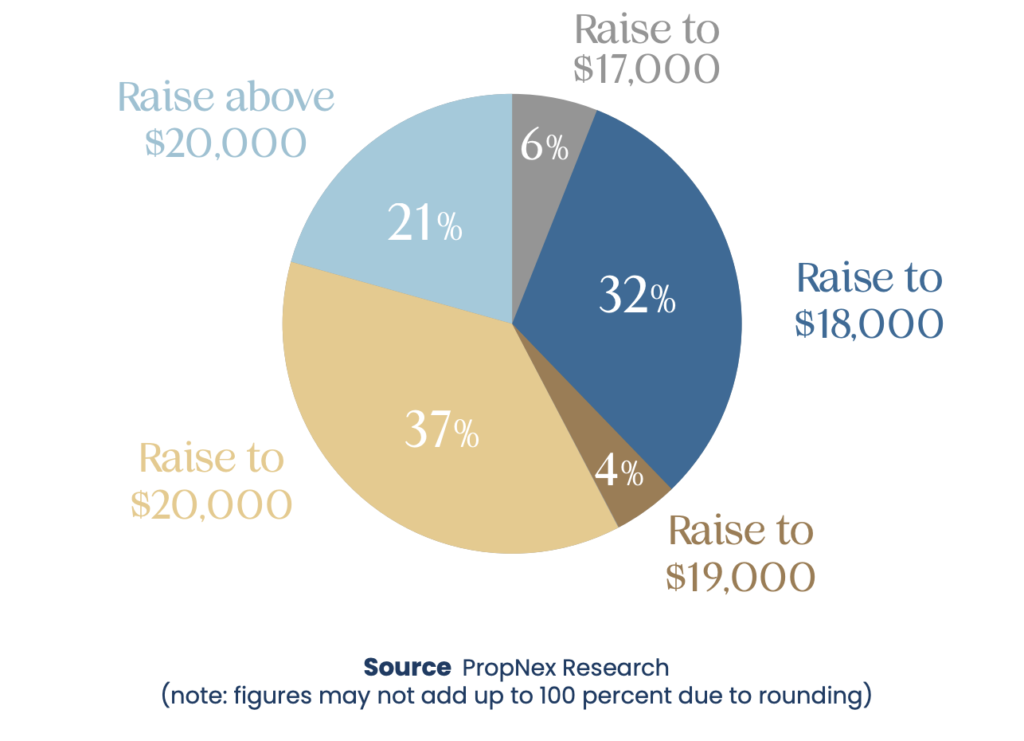

If it is to be revised, which is the appropriate income ceiling

for new EC purchase?

Among the respondents who indicated that the monthly household income ceiling for new EC purchase should be revised, about 58 per cent of them said that it should be raised to $20,000 or higher. Meanwhile, 32 per cent of the respondents said that an income ceiling of $18,000 may be appropriate (See Chart 10).

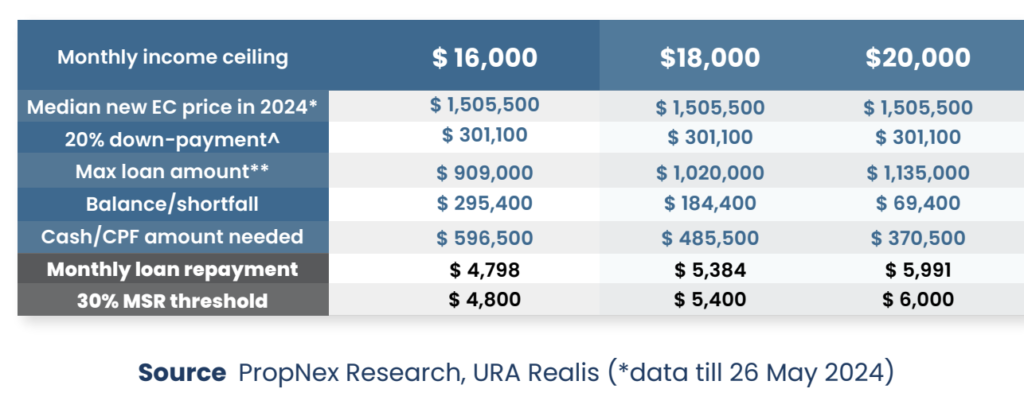

At the prevailing household income ceiling of $16,000 per month, prospective EC buyers would be able to obtain a bank financing of around $909,000, based on an MSR of 30%, an interest rate of 4% p.a. and a 25-year loan tenure. Factoring in the bank loan amount, it would still leave a shortfall of $295,000 to be paid, after the buyer puts a 20% downpayment of $301,000 under the Deferred Payment Scheme (DPS), assuming the EC purchase price at $1.5 million (which was the median transacted price of new ECs in 2024 up till 26 May (see Table 6).

The downpayment and shortfall would come up to nearly $600,000 which the EC buyer has to pay in a combination of cash and monies from their Central Provident Fund (CPF) account. This is a substantial sum for many couples and may put new EC units out of their reach, if they do not have enough savings or access to financial help from family members.

Should the monthly household income ceiling be raised to $18,000 and holding other factors constant, the downpayment and shortfall drops to $485,500; this amount is substantially reduced further to $370,500 if the income ceiling is lifted to $20,000 per month (see Table 6).

Table 6:

Illustration on EC purchase financing at various monthly

income ceiling amounts

**loan amount based on MSR of 30%, 4% p.a. interest, and 25-year loan tenure, ^Applicants buying a new EC unit under the Deferred Payment Scheme pays a 20% down-payment using cash or CPF during the signing of the S&P agreement. The remaining amount will be paid when the project attains Temporary Occupation Permit (TOP)

Conclusion

Based on the views gathered from HDB flat owners, the general sentiment seems to be that ECs remain relevant in meeting the private housing aspirations of Singaporeans, although a substantial portion of respondents are of the view that EC launches have become unaffordable. With a monthly household income ceiling of $16,000 as an eligibility condition to buy new ECs, coupled with the 30% MSR, some respondents felt that there is room for these to be adjusted, which could improve the affordability of ECs.

Naturally, there will be concerns on the potential unforeseen impact of such policy changes. For example, the adjustment to the income ceiling could lead to more higher income buyers entering the market, and inadvertently crowding out households with lower income. There may also be worries about some developers possibly taking advantage of the higher income ceiling and higher MSR by raising the selling price of ECs.

These are valid concerns and one way that the government can address them is to consider releasing more EC GLS sites under the Confirmed List in its half-yearly land sales programme. Having a substantial EC supply will discourage developers from bidding too aggressively for EC plots and may help to stabilise the selling prices of such homes.

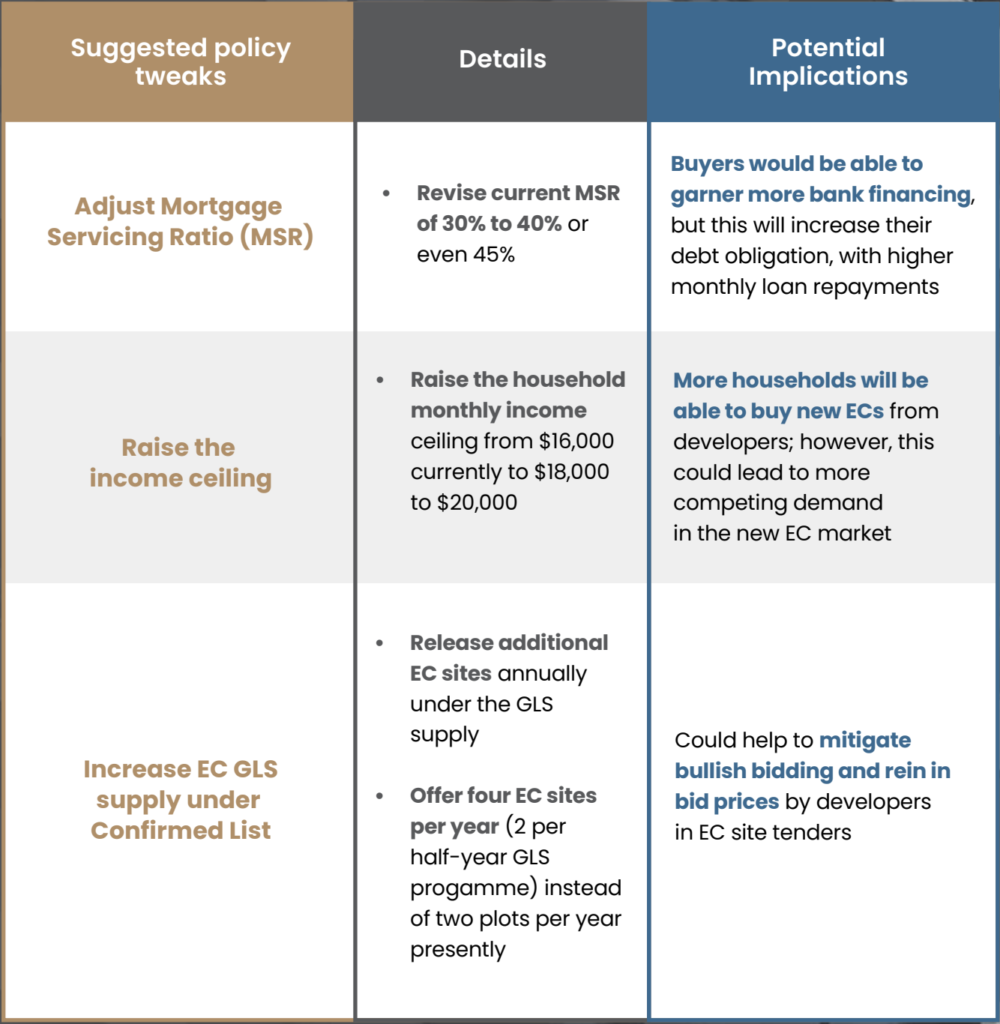

To this end, PropNex would like to recommend that the government consider revising the following housing policies (see Table 7) which could help to ensure that new EC units continue to remain affordable to the “sandwiched class”.

A. Adjusting the MSR threshold from the current 30% to either 40% or 45% for the purchase of new EC units from developers. The MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying property loans

B. Raising the monthly household income ceiling for new EC purchase from $16,000 to $18,000 or $20,000

C. Ramping up the supply of new EC government land sales sites from two plots a year to four sites a year under the Confirmed List

Table 7:

Summary of proposed suggestions to improve EC affordability