Q2 2024 Shophouse Property Report

Overview

Shophouse sales momentum slowed slightly during the quarter, amid the tepid market sentiment and mismatch in pricing expectations. While market observers note that investment interest in commercial shophouses remains relatively healthy, deals are taking more time to conclude due to the extensive due diligence and anti-money laundering checks. Shophouse rentals continued to climb, amidst the recovery in the tourism sector and the healthy performance in the services sector.

Sales Transactions in Q2 2024

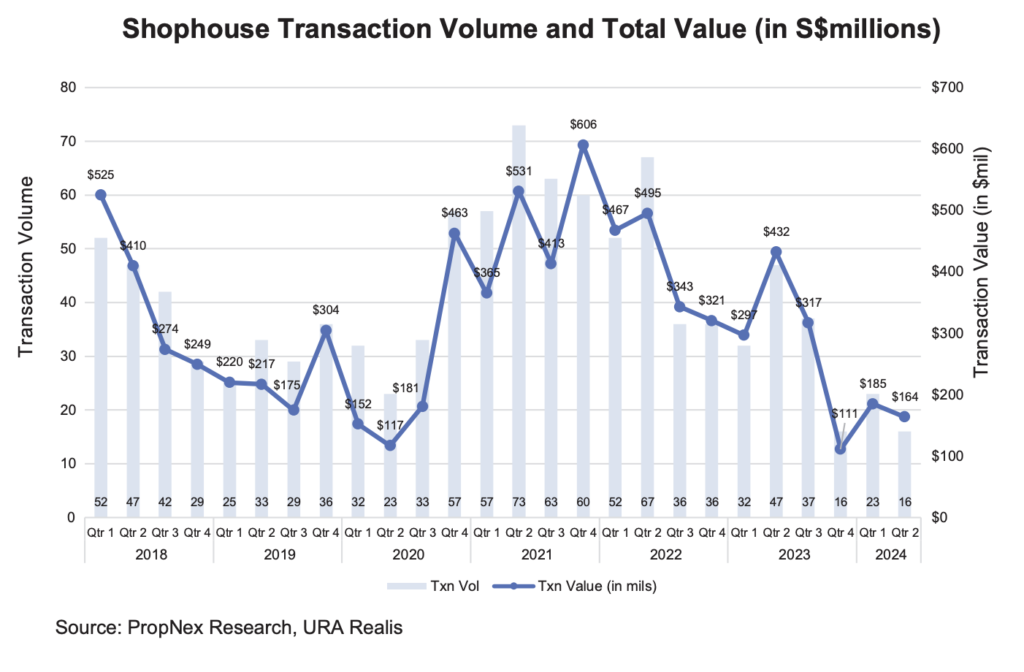

- Based on caveats lodged, there were 16 shophouse transactions in Q2 2024, falling by 30% QOQ from the 23 deals in Q1 2024. This is another recent low for the quarterly sales for shophouses – matching the previous low in Q4 2023, where 16 shophouses were sold. The drop in recorded transactions can also be attributed to more buyers choosing not to lodge caveats since it is not mandatory to do so. Therefore, the actual sales figure in Q2 could possibly be higher.

- Year-on-year, the volume of shophouse transactions in Q2 was down by 66% from the 47 deals in Q2 2023. The pullback in sales could be attributed to the tentative market sentiment, seasonal lull, and stringent due diligence checks.

- The shophouse deals in Q2 2024 amounted to $164 million, marking a 11.5% decline from the previous quarter. On a year-on-year basis, the sales value fell by about 62% from $432 million in Q2 2023. The decline can be attributed to the slower sales activity during the quarter.

- In the first half of 2024, about 39 deals worth $349 million were recorded – significantly slowing from the second half of 2023 where 53 deals worth $428 million were done.

Transactions Hotspots in Q2 2024

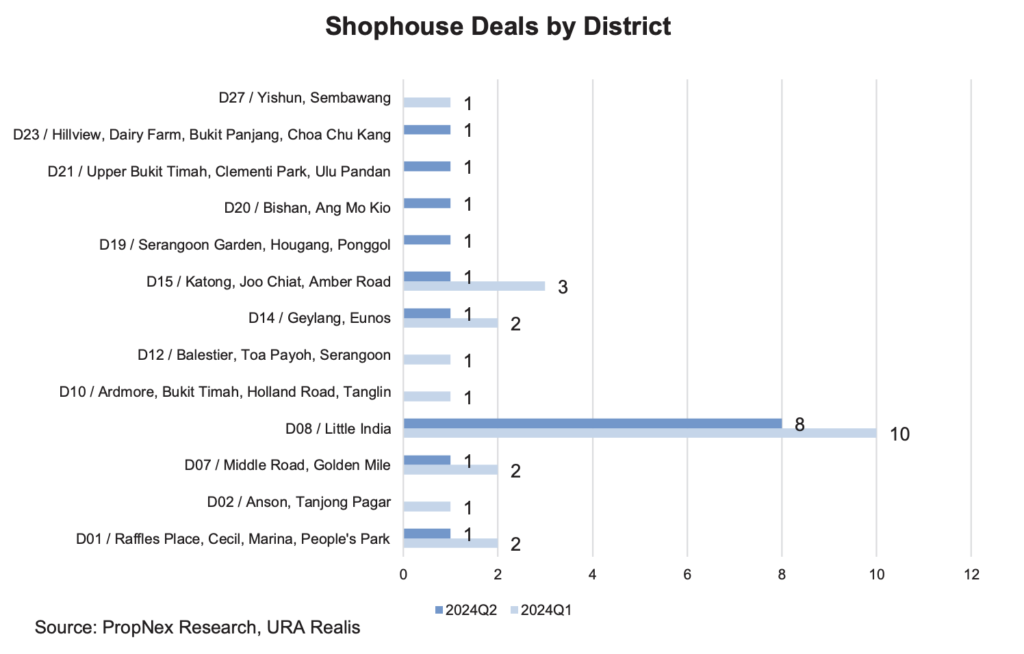

- Of the 16 shophouse transactions in Q2 2024, District 8 (Little India, Jalan Besar) posted the highest sales with eight deals.

- PropNex salespersons noted that there were nearly a dozen deals for which caveats were not lodged, namely in Districts 1, 2, 7, 14, and 15.

- Of note, several shophouses linked to the money laundering probe had been reportedly put up for auction by DBS Bank earlier this year. Based on anecdotal accounts from market observers, a handful of the shophouses have been successfully auctioned, although no caveats were lodged for the sale. These shophouses are in several locations, including Amoy Street, Geylang Road, and Chinatown.

Top 5 Shophouse Transactions in Q2 2024

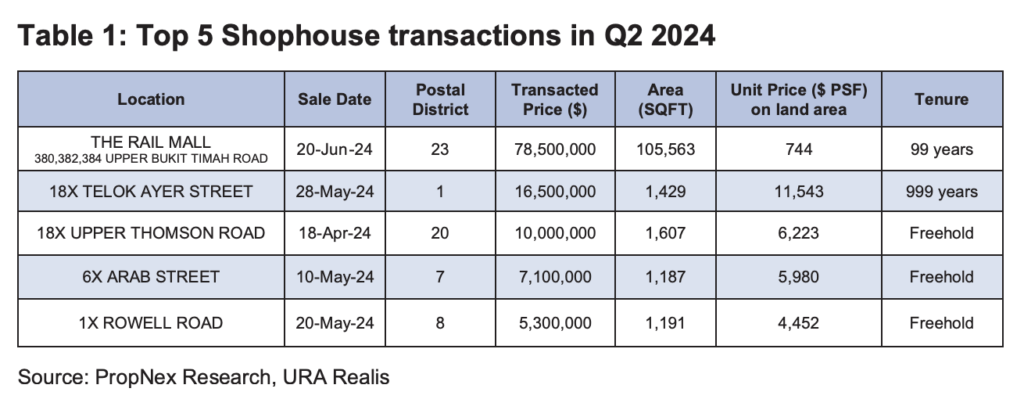

Based on URA Realis caveats data, the top transaction of the quarter was the sale of The Rail Mall in Upper Bukit Timah Road for $78.5 million in June. The Rail Mall, has nearly 50,000 sq ft of net lettable area, and sits on a 99-year leasehold tenure site, with its lease from March 1947.

The Rail Mall has nearly full occupancy, with a tenant mix comprising mostly of eateries and a supermarket anchor tenant. The site was sold by Paragon REIT to an entity linked to Woh Hup Holdings, a local construction firm.

The second top deal of the quarter was for a 3-storey conservation shophouse along Telok Ayer Street in the city – on a 1,429 sq ft site – which was sold in May for $16.5 million.

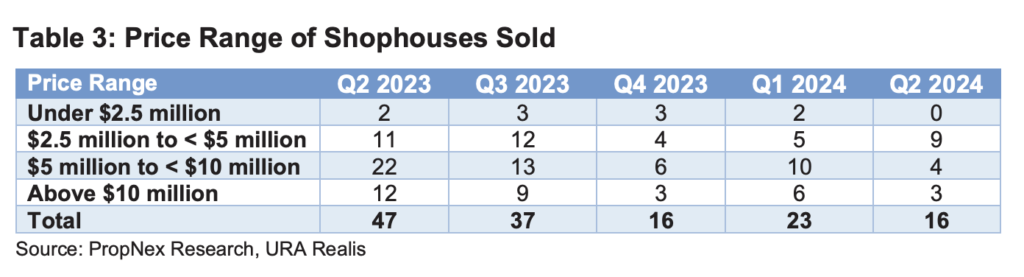

There were fewer big-ticket purchases during the quarter. Based on caveats lodged, of the 16 shophouse deals in Q2 2024, more than half (56%) or nine deals were priced at between $2.5 million and $5 million, while the other 44% or seven deals were priced at above $5 million.

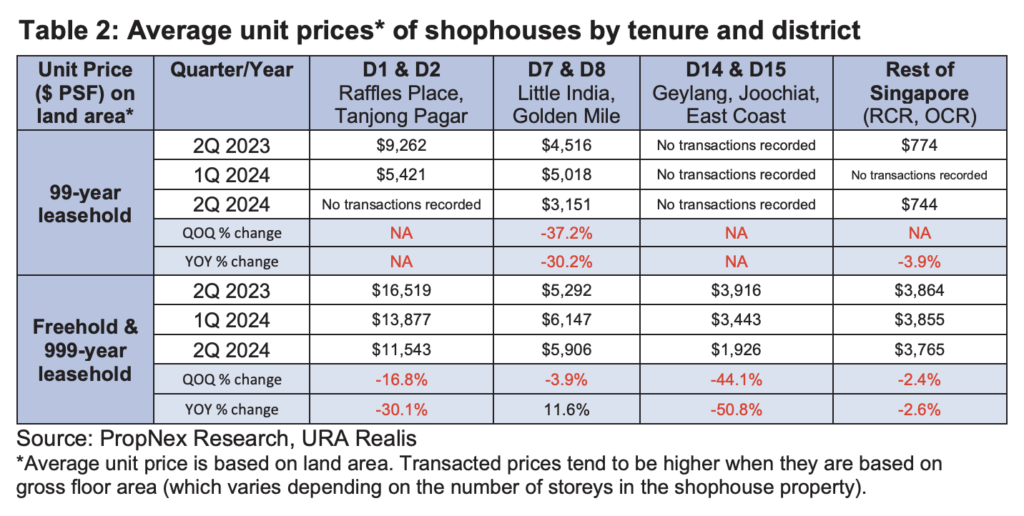

Shophouse Prices

In Q2 2024, shophouse prices across the island slumped compared with the previous year. The price decline was uneven across the districts, in part due to the smaller sales volume during the quarter

The average transacted unit price on land area* of freehold and 999-year leasehold shophouses in D1/2, D14/15 and the rest of Singapore fell by 30% YOY, 51% YOY and 2.6% YOY, respectively. In contrast, the average price of D7/D8 shophouses bucked the trend, expanding by 11.6% YOY.

99-year leasehold shophouses in D7/8 saw the average unit price on land area decline by 30% YOY, while prices of 99-year leasehold shophouses in the rest of Singapore fell by 3.9% YOY.

Rents

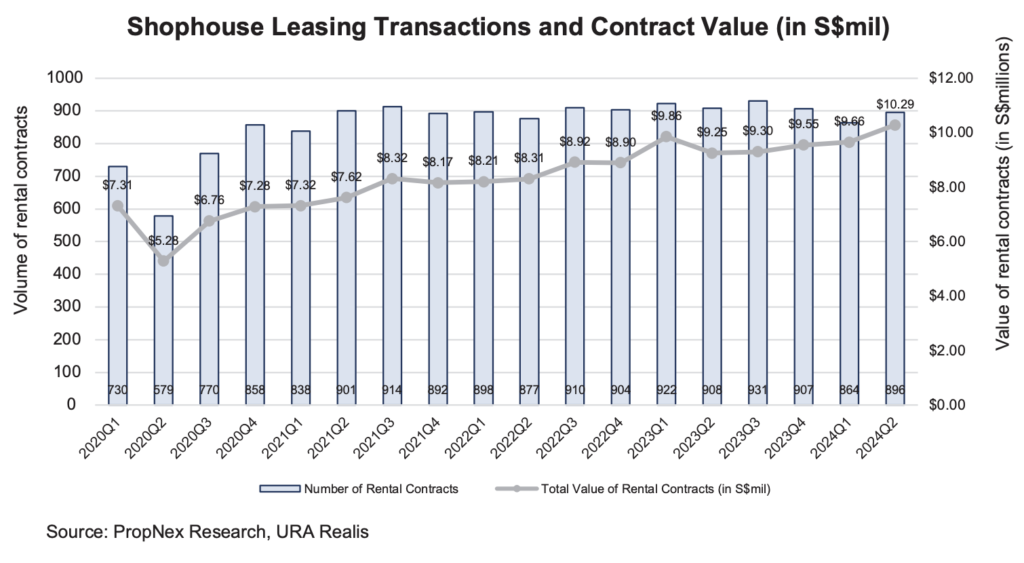

Rentals for shophouses in Q2 2024 remained firm, supported by the improvement in the services sector. Occupancies of shophouse space remained tight amid healthy demand, particularly for shophouse space in popular tourist districts.

In Q2 2024, 896 rental contracts valued at about $10.3 million were signed. In the first six months of 2024, about 1,760 contracts worth $19.9 million were signed – slightly underperforming the same period last year, where 1,830 contracts worth about $19.1 million were signed.

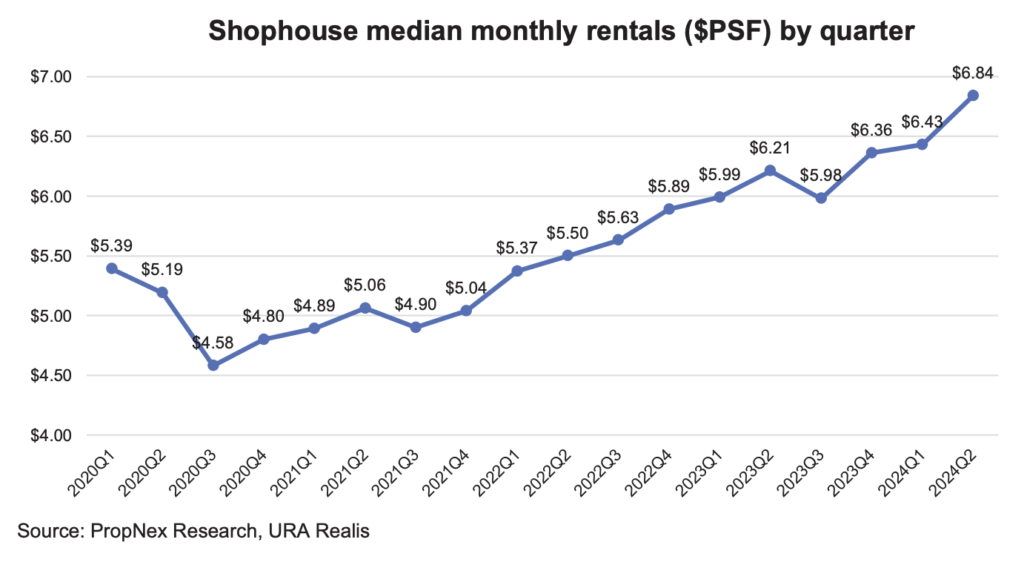

Shophouse rentals continued to expand in Q2 2024, building on the growth in Q1 2024. According to caveats lodged, monthly median rents of shophouses grew by 6.4% QOQ to $6.84 psf in Q2, hitting a new high for median shophouse rentals.

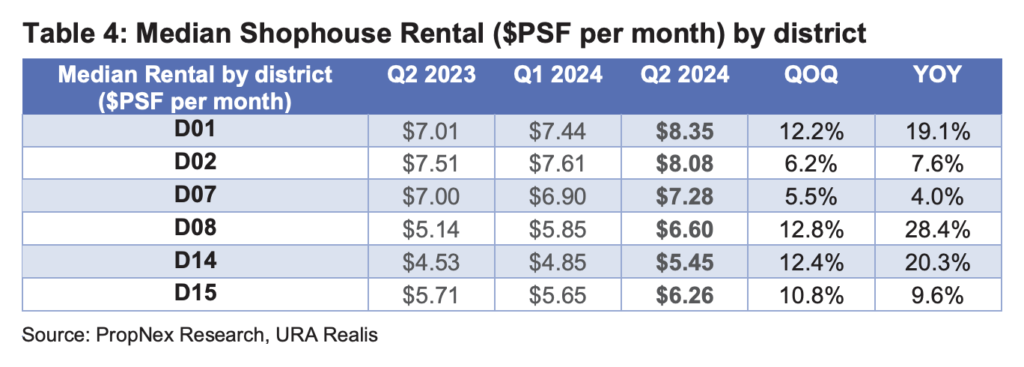

In Q2, rentals of shophouses in the popular districts hit new highs amid tight occupancies and their strong location attributes. City fringe shophouses led the growth in rentals, with those in District 8 (Little India) and District 14 (Geylang, Eunos) posting 12.8% QOQ and 12.4% QOQ growth, respectively. Shophouses in the city centre also saw a positive growth in rentals during the quarter – median rentals in District 1 (Raffles Place, Cecil) grew by 12.2% QOQ, reaching a record high of $8.35 psf pm.

Market Outlook

Several factors may continue to put a drag on buyers’ sentiment in the commercial shophouse market over the medium-term, including market uncertainties, pricing disparities, limited availability of units for sale, and repercussions from last year’s anti-money laundering crackdown, necessitating more rigorous due diligence checks.

Amidst the subdued sales, retail investors could capitalise on the soft market sentiment to explore opportunistic purchases in the shophouse segment. Shophouse sales may be more forthcoming in the fringe and secondary settlement areas, where sellers may be more receptive to price negotiations. Meanwhile, transactions could be sluggish in the prime districts, given the strong retention of shophouses by existing owners. Overall shophouse prices may fluctuate over the near-term due to the limited transaction volume.

In the second half of 2024, PropNex anticipates the following factors could be supportive of the shophouse market: projected economic recovery in Singapore in the latter half of the year; and the continued pick-up in the tourism sector owing to the various sports, concerts, and MICE events.