Private Residential Property Q2 2024

Overview

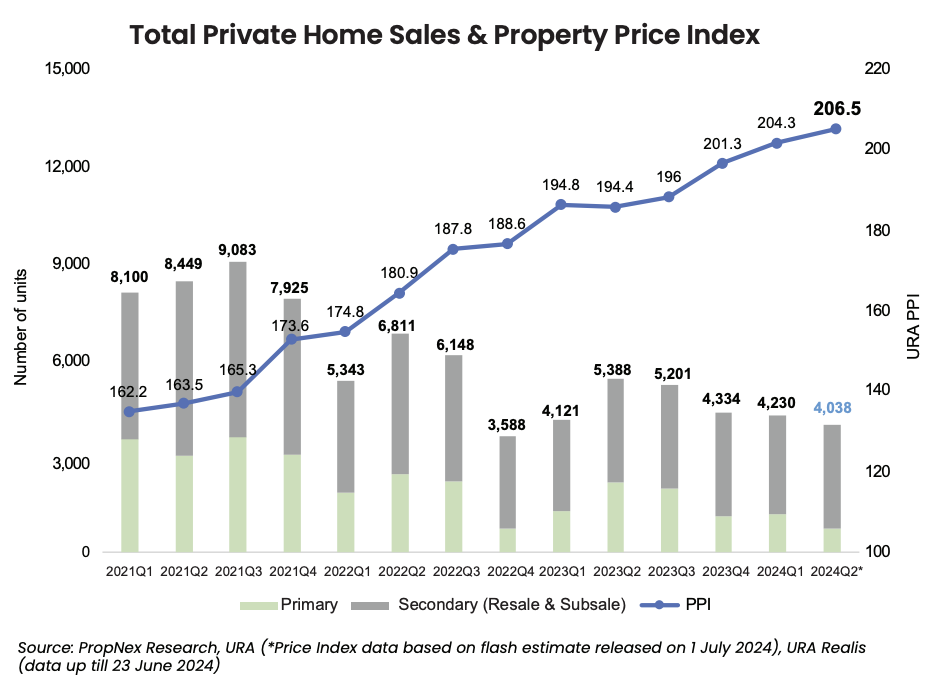

Despite the relatively tepid home sales owing to limited new project launches, overall private residential property prices continued to climb in Q2 2024 – albeit at a more moderate pace compared with the previous quarter.

Price

- URA’s flash estimates showed that overall private home prices rose by 1.1% QOQ in Q2 2024, slowing from the 1.4% QOQ increase in Q1.

- The price growth in Q2 2024 was led by the landed homes segment, where prices climbed by 1.8% QOQ, easing from the 2.6% QOQ increase in the previous quarter. The price growth came amid an increase in transaction volumes of landed homes during the quarter.

- According to caveats lodged, there were 429 landed home transactions in Q2 2024 – picking up from the 378 transactions in Q1.

- Based on URA Realis caveat data, average unit prices of detached homes ($1,796 psf) and terrace houses ($1,870 psf) led the price increase, growing by 6.7% QOQ and 5.9% QOQ respectively. Semi-detached homes ($1,724 psf) saw their average unit price inched up by just 0.6% QOQ in Q2.

- In the non-landed private homes segment, prices crept up by 0.9% QOQ in Q2. The price growth was mainly spurred by the Rest of Central Region (RCR) sub-market.

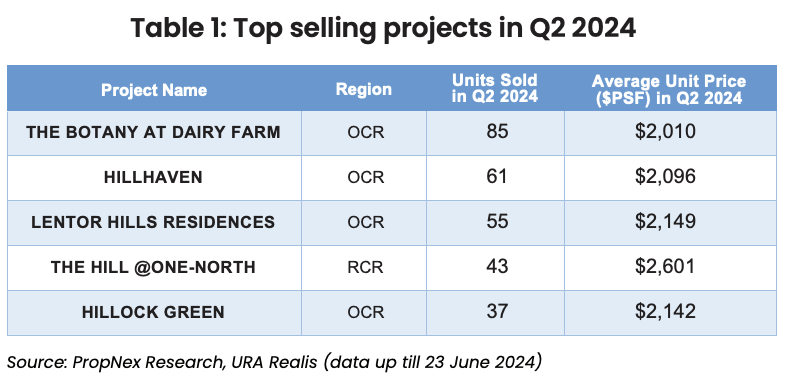

- Non-landed home prices in the RCR grew by 2.2% QOQ, accelerating from the 0.3% QOQ increase in Q1. Transactions at The Hill @ One North had helped to lift prices during the were 3,073 private homes sold on the resale market in Q2 2024 – rising by 14.3% QOQ from Q1 2024, where 2,689 resale homes were sold.

- One factor that is supporting resale demand is potentially the sizable price gap between new and resale homes, with the latter seen as more affordable by some buyers. According to caveats lodged, the overall average transacted unit price gap between new private homes (ex. EC) at $2,408 psf and that of resale private homes at $1,719 psf was 40% in Q2 2024.

- The volume of sub-sales declined to about 271 units, falling by 28% QOQ from Q1 2024 which saw 377 units being transacted. This takes the total private homes transactions to 3,344 units (including new sale and resale) in Q2 2024, based on the caveat data.

Private Home Leasing

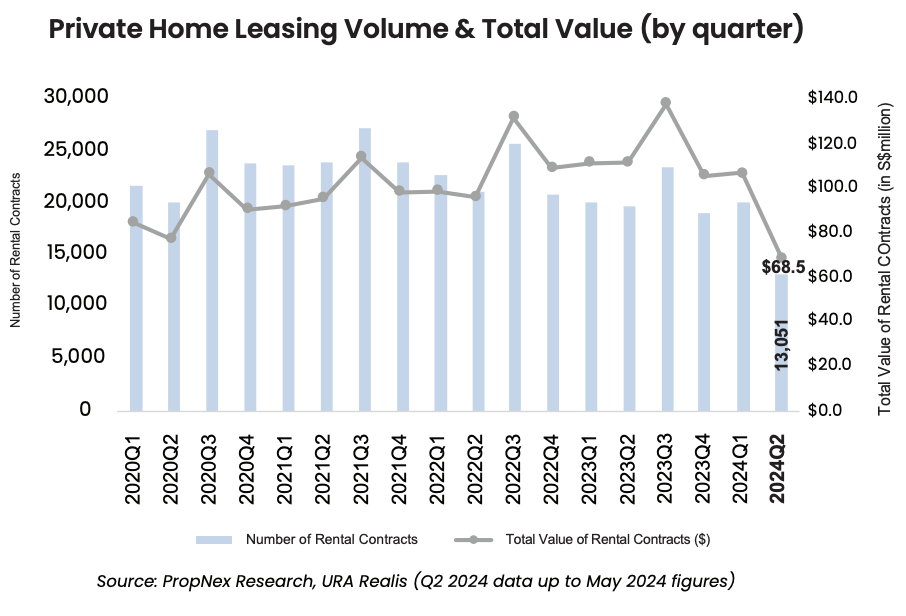

- Private residential rentals are expected to continue its downward trend in Q2 2024. In the first quarter of 2024, private home rental index fell by 1.9% QOQ, following the 2.1% QOQ decrease in Q4 2023.

- In May 2024, the median rentals of private homes stood at $4.87 psf per month – down by 5.6% from the peak in April 2023 at $5.16 psf.

- About 13,051 rental contracts, amounting to $68.5 million were signed in April and May 2024 – slightly up from 12,862 contracts worth $71.2 million signed in the same period in 2023. Rentals of private homes are expected to ease further going into 2H 2024 with the waning leasing demand.

- The moderation in the home leasing market which started in Q2 2023 was mainly driven by a quarter; it sold 43 units at an average price of $2,601 psf.

- Prices of non-landed homes in the OCR inched up by just 0.3% QOQ in Q2 – a slight improvement from the 0.2% QOQ growth in Q1. It appears that prices in the OCR could possibly be peaking in view of two quarters of marginal growths in Q1 and Q2 2024.

- The Core Central Region (CCR) sub-market saw prices slip by -0.2% QOQ in Q2, reversing from the 3.4% QOQ growth in Q1. The marginal decline in prices could be attributed to the higher base in the first quarter.

Transactions

- Home sales activity in Q2 2024 was largely led by the resale market, as there were limited new project launches in the quarter.

- Many of the fresh launches in Q2 have been boutique developments that offer fewer units, while the largest project launched was the 190-unit Skywaters Residences, a luxury project that is unlikely to fit the budget of most mass-market home buyers. The only other major launch in Q2 was The Hill @ One North, which sold about 30% of its 142 units since its launch in April 2024.

- Based on figures from URA Realis caveat data and monthly sales data, developers sold 694 new private homes (ex. EC) in Q2 (till 23 June) – set to underperform the 1,164 units sold in Q1.

- With a lack of project launches, developers’ sales look unlikely to cross the 1,000-unit mark in Q2 2024. Factoring the 1,164 units shifted in Q1 2024, developers sold over 1,850 new units (ex. EC) in the year-to-23 June 2024 period.

- The top selling project in Q2 was The Botany at Dairy Farm, in the OCR, which sold 85 units at an average unit price of $2,010 psf (see Table 1).

- The OCR sub-market drove new home sales in Q2 making up about 57% of new homes sold.

- Activity in the resale market remained resilient during the quarter as buyers hunt for value-buys. Based on caveats lodged, there sharp increase in the number of new homes being completed. More than 21,200 new units of private homes (including EC) were completed in the whole of 2023, injecting fresh rental stock to the market. Meanwhile, as completions get ramped up, former tenants received keys to their new homes and need not rent anymore, releasing more units into the rental supply.

Private Residential Market Outlook

In view of the slow sales in Q2, PropNex has revised its projections for new private home sales to around 6,000 to 6,500 units (ex. EC), from the initial forecast of 7,000 to 7,500 units (ex. EC) for the whole of 2024. PropNex remains optimistic that developers’ sales will pick up in Q3 2024, as several more sizable projects are expected to be launched for sale. For the full year 2024, the overall private home prices could rise by 4% to 5% – slowing from the 6.8% increase in 2023.

Home sales have been lukewarm, particularly in the primary market where a limited number of project launches has weighed on the transaction volume. Some homebuyers could be holding out for more projects to come onstream later in the year, so that they have a wider range of options. Based on observations from consumer seminars and engagement events that were conducted in the past months, there is still ample interest in private residential properties, but prospective buyers are seeking more clarity on how prices will move going forward, and perhaps looking to compare between projects as new launches come on.

Some of the new projects that could be rolled out in Q3 2024 include Sora in Yuan Ching Road, Kassia in Flora Drive, Emerald of Katong in Jalan Tembusu, The Chuan Park, Arina East Residences in Tanjong Rhu, the Bukit Timah Link project, Meyer Blue, and Union Square Residences which can collectively offer more than 3,300 new private residential units.

With buyers being selective and more price sensitive, developers will likely focus on keeping the price quantum affordable at the early stages of launches to drive sales momentum.

HDB Resale Q2 2024

Overview

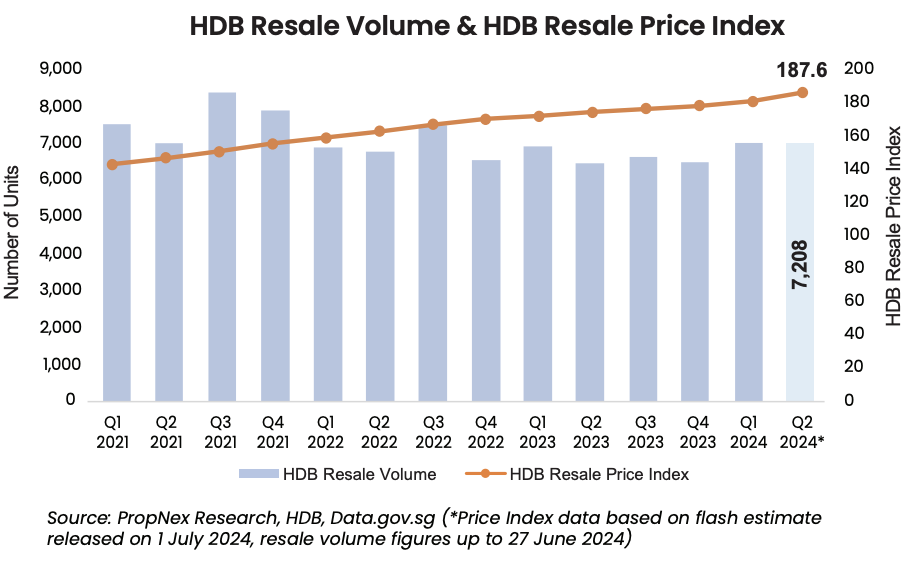

In Q2 2024, HDB resale flat prices continued to rise, building on the growth in the previous quarter. Flash estimates released by the Housing and Development Board (HDB) indicated that resale flat prices rose by 2.1% QOQ in Q2 2024, accelerating from the 1.8% QOQ increase in the previous quarter. This marks the 17th straight QOQ growth in the HDB Resale Price Index.

Transactions and Prices

- As per the flash estimates, the HDB resale price index is at a new high in Q2 2024 with an index reading of 187.6 points, reflecting an increase of 2.1% QOQ – the highest quarterly price gain since Q4 2022 (+2.3% QOQ)

- The price growth is likely supported by several factors, including healthy resale flat demand, a higher number of flats resold for at least $1 million, a slightly larger proportion of flats sold at a higher price range, as well as a steady proportion of relatively newer resale flats sold during the quarter which supported prices.

- Based on figures from the HDB, 7,208 flats (data up till 27 June 2024) were resold in Q2 – up by 14.5% from 6,297 resale flats transacted over the same period last year.

- Including the 7,068 flats resold in Q1 2024, there have been more than 14,200 resale flats transacted in the year to 27 June 2024 period.

- According to sales data, the average resale price of 5-room flats rose by 2.8% QOQ to about $724,000. Meanwhile, the average resale prices of 3-room and 4-room flats were up by 2.7% QOQ and 2.5% QOQ respectively in Q2 2024.

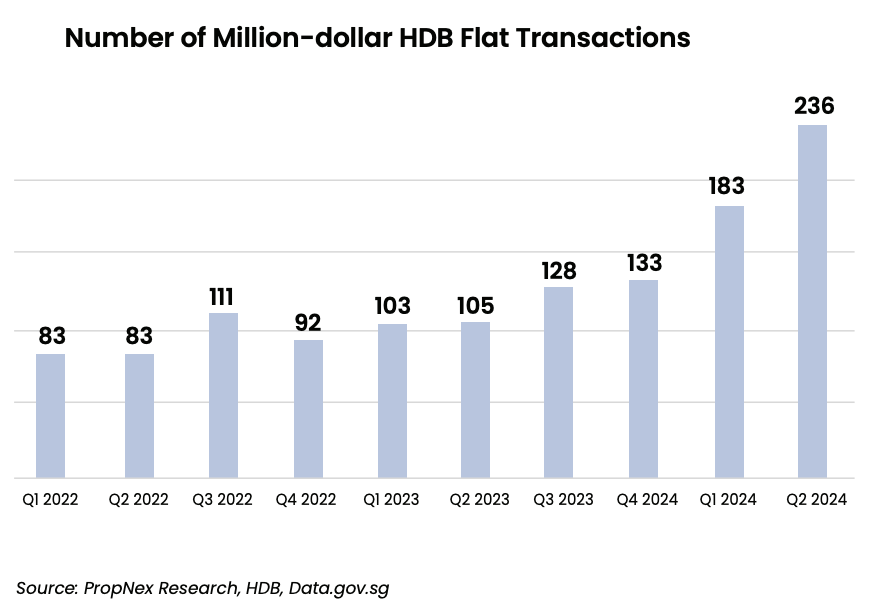

- Meanwhile, the number of HDB flats resold for at least $1 million has risen for the sixth straight quarter in Q2 2024, with a record 236 such flats sold – up by about 29% from 183 such flats sold in the previous quarter.

- This takes the number of such flats transacted to 419 units in the first six months of the year – and it looks likely to breach the record of 469 units resold in the entire 2023. In Q2 2024, million-dollar resale flats made up around 3.3% of the quarter’s sales, based on transaction data

HDB Resale Market Outlook

HDB resale prices have largely stabilised from the double-digit growths seen in 2021 and 2022. That said, the number of million-dollar flats resold has picked up in the first half of 2024. While the buyer profile details of such flats are not available, it is possible that former private home owners who have sat out the 15-month wait-out period (introduced in September 2022) could have returned to the market and pushed up the sales number.

PropNex expects the demand for HDB resale flats to remain resilient for the rest of the year, with the overall annual HDB resale volume possibly coming in at 27,000 to 28,000 units in 2024. PropNex projects that the overall HDB resale prices could rise by 6% to 7% for the whole of 2024.

Meanwhile, the HDB is expected to launch about 8,500 new flats for sale under its Build-to-Order (BTO) exercise in October, including in attractive locations in Kembangan, Bayshore, Kallang Whampoa, and Ang Mo Kio. These could potentially draw some buyers away from the HDB resale market, particularly those who do not mind waiting some years to get their new home.