Singapore Real Estate Outlook 2024

The hard truth is, although there are people who Make A Lot Of Money in the property market, there are also people who Lose Money in it. This happens when proper analysis and research is not done correctly beforehand.

In 2023 alone, there were 470 million-dollar HDB transactions. In January 2024, a Toa Payoh DBSS unit was sold at an Island Record price of $1.56 million. Do you believe it will continue to climb, especially with the emergence of so many Million-Dollar Flats?

We personally believe that due to inflation and the increase of Emotional Buyers or Private Downgraders, we might continue to see this trend (Super Prime Location Housing, Jumbo Flats etc), although it’s an exception.

In 2023, there were 26,628 HDB transactions, and million-dollar flats accounted for Less Than 1.8% of them.

What do you think will be the Overall Direction of the HDB market? Allow me to share some Government Directives, Data, and Historical Trends for you to consider.

In 2011, as HDB flat prices Appreciated due to strong demand and Insufficient Supply in Singapore, discontent among Singaporeans arose.

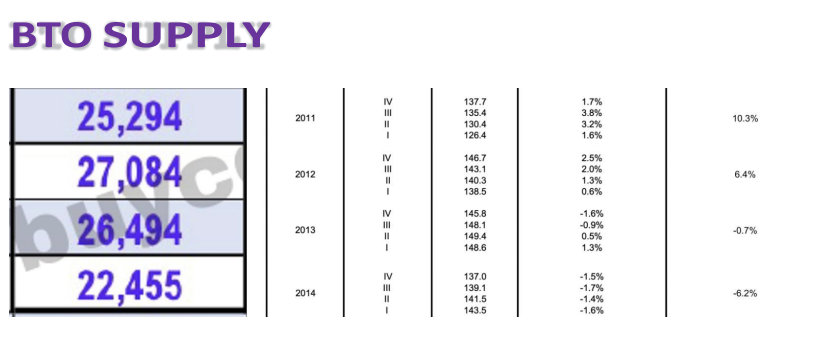

In response, the then National Development Minister, Khaw Boon Wan, announced measures to address the issue. The plan involved building more than 100,000 Flats from 2011 to 2014, aiming to alleviate the backlog in demand that had been a concern at that time.

After the measure was introduced in 2011, HDB prices began to Decline in 2013. Will we observe a similar pattern?

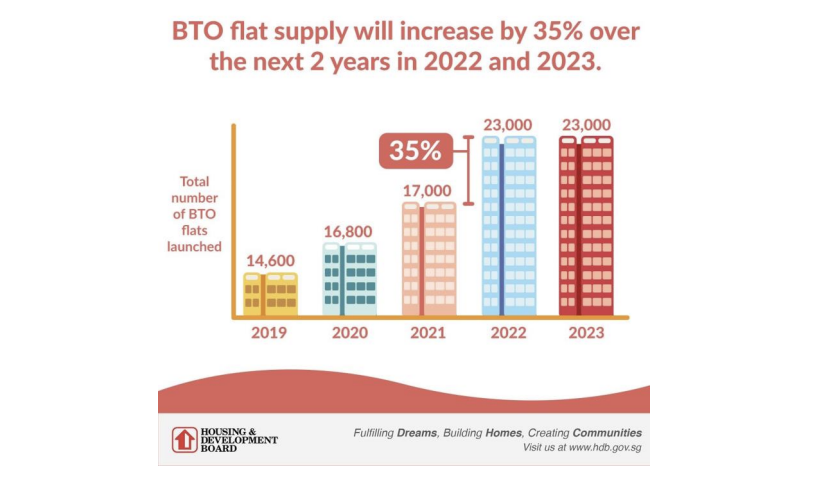

In 2020, due to COVID-19 and the delay of BTO projects, coupled with changes in homeowners’ needs, the HDB price index Soared by close to 40%, causing concern for the government.

It is crucial that HDB remains Accessible and Affordable for Singaporeans of all income groups. As a response, several measures have been laid out.

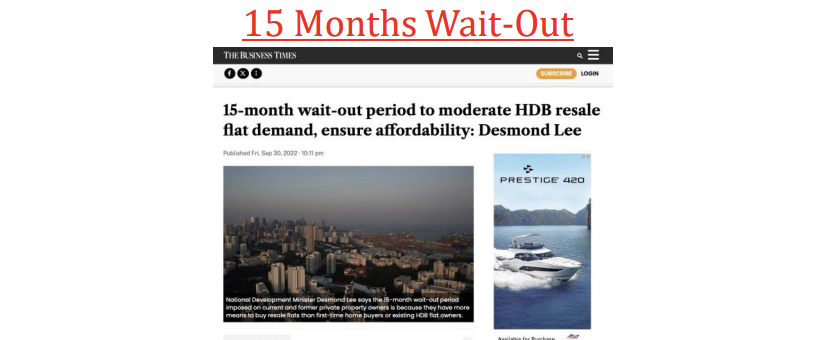

One of the measures introduced to moderate demand in the HDB resale market is the government’s imposition of a wait-out period of 15 months for private residential property owners looking to purchase a nonsubsidized HDB resale flat.

This will serve as a form of Deterrence for buyers with deep pockets so the demand from the private sector will cool.

In order to further curb the rise in HDB pricing, the government introduced a second measure, repeating their strategy that worked in 2011 by increasing the BTO supply. As you can see in the article above, Desmond Lee aims to build 100,000 HDB units in four years.

With such a High Supply coming in, do you think HDB will continue to remain strong? A similar scenario occurred in 2011, and this trend is likely to repeat.

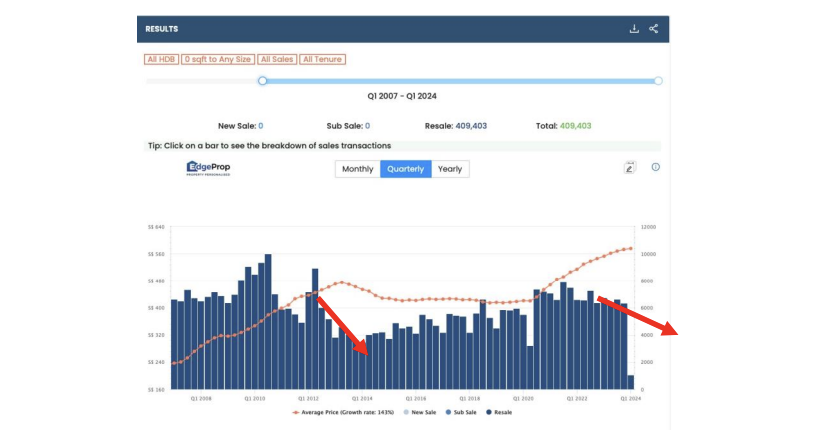

The existence of COV is now less prominent in the market as bullish demand has cooled down, as evident from the volume shown in the chart below. In 2012, the volume started to drop initially as a group of buyers chose not to accept the Peak Prices and turned their attention to the BTO market. During that period, a tug of war ensued as sellers sought high prices while buyers were unwilling to accept, causing Price Disparity.

Moving on to 2013, you’ll notice that the price index started to drop as price disparities equalized.

So, Volume = Demand will drop first, and then prices will follow suit. If you observe, market volume has also started to decline from 2022 since the government introduced more BTOs.

It took two years from 2011 to see a Correction in 2013. The government began ramping up supply in 2022, so what do you think the price index will be in 2024?

As the saying attributed to Mark Twain goes, ‘History may not repeat itself, but it often rhymes.

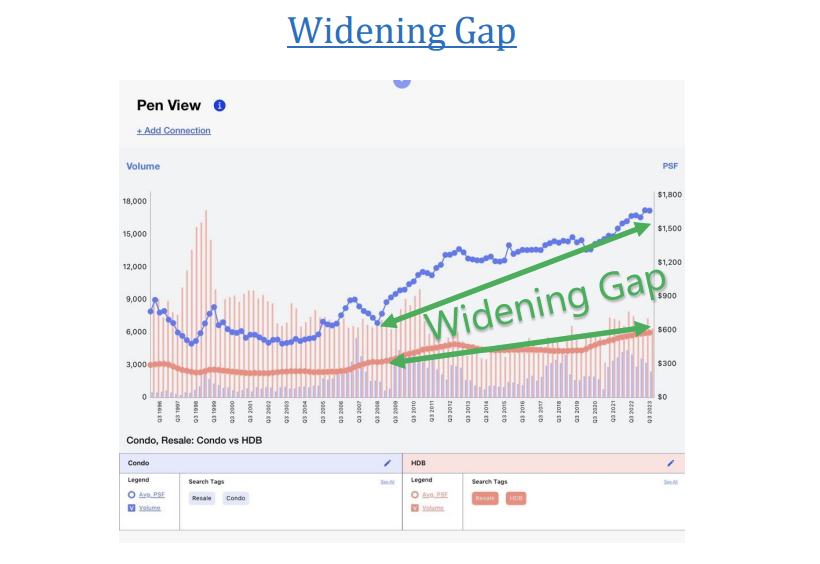

We believe that the HDB Price Index is at a new high today, and private properties might be at a new low. Is it a good time to swap, especially when the price index is Widening? This might be the last chance to board the Runaway Train.

It has been another year of growth in the Singapore Real Estate Market, with the market appreciating by 6.7% in 2023. The golden question is whether our market will continue this Upswing, or if we will see a Correction in 2024.

To be honest, such data is usually examined from a macro perspective,where the sample size is Too Large. Certainly, the overall market appears to have risen by 6.7%, but this is an average encompassing everything (All Transactions in 2023). There are certainly transactions that Underperformed and Overperformed as well.

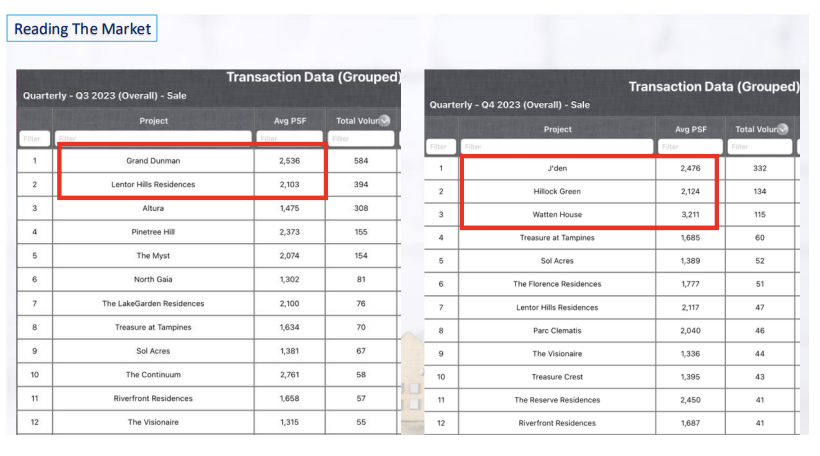

One of our clients called us and asked, ‘Why does it feel like the market Slowed Down in Quarter 4, yet home prices are up by 2.7%? This discrepancy arises because we are looking at it from a macro perspective, which includes new launches that contribute significantly to the market volume during their launch.

If we examine the Major Transactions in Q3 2023, Grand Dunman averages at 2536psf, and Lentor Hills Residences at 2103psf. However, in Q4 2023, there were emotionally driven purchases; J’den averaged at 2476psf, and Watten House at 3211psf.

By looking at these transactions, isn’t it quite obvious that the market is likely to experience a 99% upswing? Sometimes, with such numbers, we can easily predict and forecast the market direction from a macro perspective.

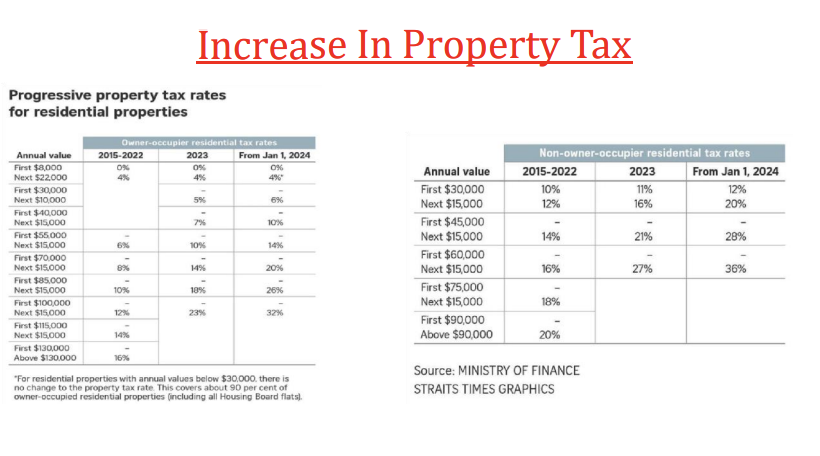

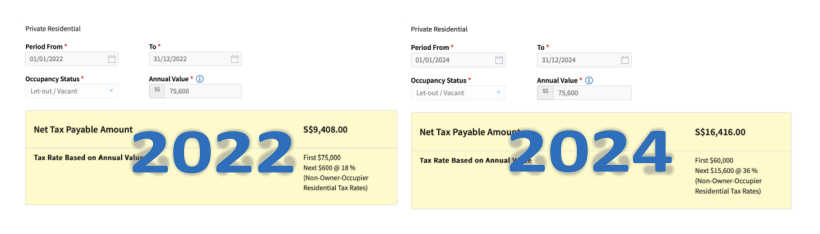

If we examine the property tax, you’ll notice that the increase is quite Substantial. I’ll illustrate with one of our client rental property as an example, with an Annual Value of $75,600.

In the span of 2 years, property taxes have surged by 74.5%! This isquite perplexing, considering that our rental rates definitely did not increase by such a margin.

This is excluding our mortgage interest, maintenance fees, potential wear and tear, agent fees, and income tax.

So, the question arises: Can our property investment strategy remain Passive, or should we explore Active Investments where transitioning to newer projects allows us to Defer full mortgage interest, maintenance fees, and property taxes for the initial years.

The government’s action could be intended to Discourage multiple property owners from engaging in Property Hoarding, given that it no longer seems as financially rewarding.

We personally believe that property prices will not decrease significantly, given that most homeowners have substantial Holding Power. With Loan-to-Value (LTV), Total Debt Servicing Ratio (TDSR), and Additional Buyer’s Stamp Duty (ABSD) enforced by the government, they ensure that individuals meet are Financial Criteria before enabling them to leverage with the bank.

The Decrease in transaction volume attributed to Higher Interest Rates. Additionally, the appeal of rental investments has Diminished compared to before, partly due to Interest Rates and an increase in Property Taxes.

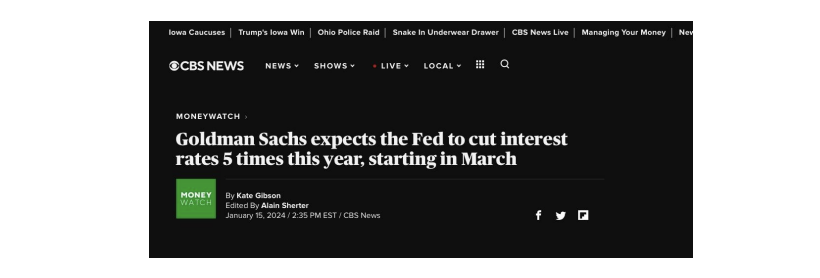

However, we are expecting the Fed to cut rates five times this year, starting from March which is Good News for home buyers & owners.

Decreased Interest Rates not only Lower Borrowing Costs, enhancing mortgage affordability but also Boost transaction volumes in the real estate market. The heightened demand, coupled with increased investor interest, can potentially drive property prices Upward as a result of the inverse relationship between interest rates, transaction volume, and property prices.

We anticipate an Increase in Demand during the second half of the year. While many Singaporeans are adopting a wait-and-see approach, we firmly believe that fortune Favours The Brave and we need to take action before the storm arrives.

2024 Opportunities

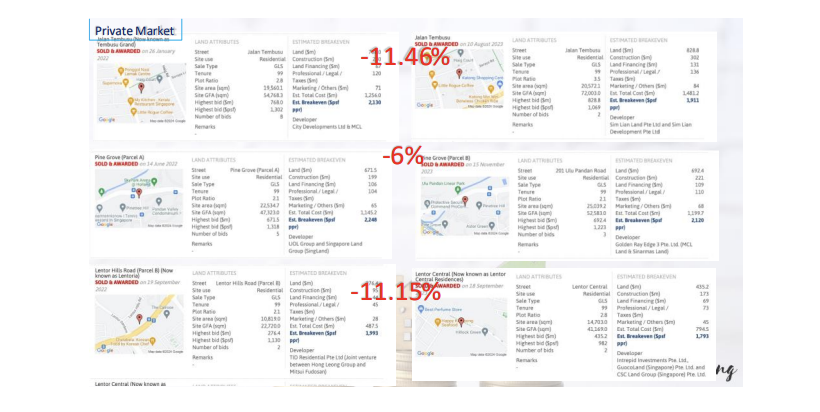

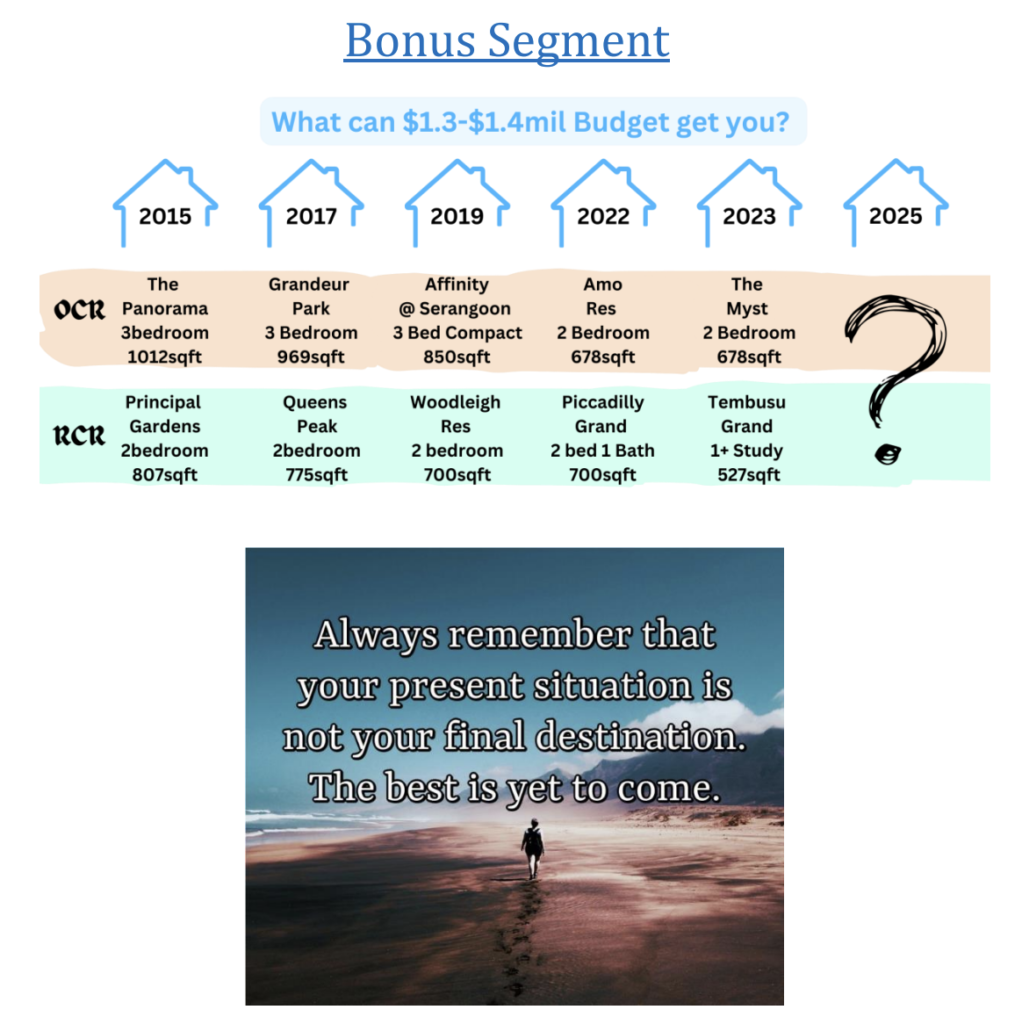

What Opportunities exist in 2024? We personally believe there are interesting projects worth exploring. Developers secured these projects with lower land bids compared to their nearby neighbours, potentially allowing for lower launch prices.

This is not the first time it happened in Singapore and homeowners that seized this opportunity did reap a handsome reward.

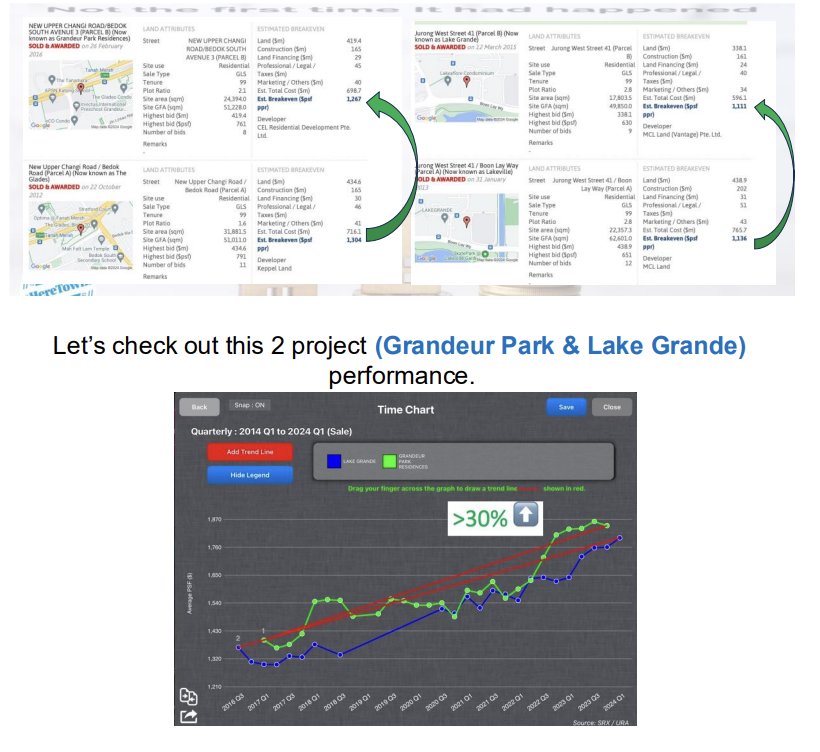

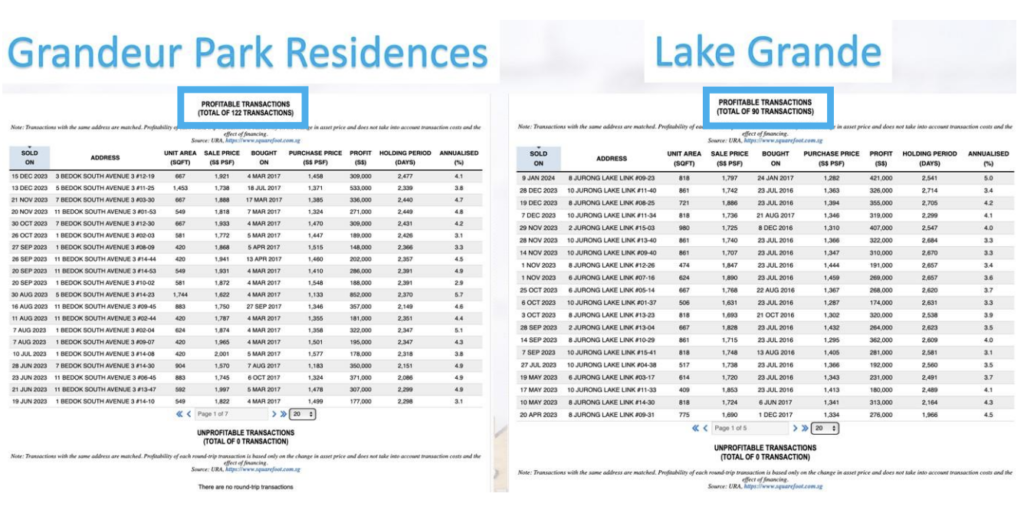

This project appreciated more than 30% on an average since launched being one of the best performance project in the last 8 years. Furthermore, all the sellers made profits and none lost money.

In summary, I usually prefer to focus more on the micro perspective instead of the macro perspective to help my clients make Well-informed Decisions.

In a good or bad market, there will always be homeowners who Made money and Lost money. We dive deep into our research and numbers to help our clients eliminate as many risks as possible.

I am look forward to value add more to your real estate journey through my intense research and expertise.

After reading through the e-book, you would have gathered some critical information on how to avoid making common and fatal mistakes that many home buyers and investors make. To maximise your real estate investment opportunities, we will share experienced opinions on your plans and thoughts, which will enable you to derive the best possible plan for your most important decision in your lives.

What you can expect from my FREE 45 minutes consultation:

- How to use my STREET SMART Framework to gain an unfair leverage and profit from the property market today!

- How the Current Cooling Measures affects the HDB and Private property market in this current situation (both short term and long term)…and how to take advantage of it.

- The 5 Critical Mistakes you must avoid in your property purchases

- How my clients achieve Multiple Capital Appreciation with my intense research.